Foreign stocks

You can buy shares in leading companies from all around the world, including Hong Kong, mainland China and the US. With a global portfolio, you'll have the chance to profit from market volatility and earn dividends as you share in the company's growth.

What are stocks?

Stocks, also known as shares, are small pieces of a company. A company will sell these small pieces to investors as a way of raising money to use to grow the business.

Stocks can be bought and sold, usually on stock exchanges. Buying stock in a company makes you a shareholder, and means that you own a small percentage of the company. Shareholders can earn money when the company goes up in value, especially if it decides to pay out dividends*, but there are operational risks to consider.

*Note: Even if a company has a profitable year, they have no obligation to pay out dividends. It's up to each individual company to decide whether to pay them.

What are the benefits of investing in foreign stocks?

| Invest in foreign stocks |

Hong Kong stocks |

US stocks |

|---|---|---|

| You can directly invest in leading companies |

Be part of the economic powerhouses of Hong Kong and mainland China through the Hong Kong Stock Exchange (HKSE) |

Invest in a wide range of industries, trading shares from big names such as Facebook, Google, Apple, Amazon, McDonalds, Visa and Johnson & Johnson |

| You can maintain full control on your investments |

Access the greater China market and trade shares from HSBC, Tencent, China Construction Bank, Bank of Communications, Swire and many more |

Take a direct role in share trading with our transparent market information. Choose the companies you're interested in and make independent investment decisions |

| You can diversify your portfolio |

The HKSE has minimum trading requirements known as 'board lots'. For example, to invest in Tencent you must buy or sell your shares in multiples of 100 |

US stock exchanges have no minimum board lots, so you can buy or sell 1 share at a time, giving you a great opportunity to enter the market |

| Invest in foreign stocks |

You can directly invest in leading companies |

|---|---|

| Hong Kong stocks |

Be part of the economic powerhouses of Hong Kong and mainland China through the Hong Kong Stock Exchange (HKSE) |

| US stocks |

Invest in a wide range of industries, trading shares from big names such as Facebook, Google, Apple, Amazon, McDonalds, Visa and Johnson & Johnson |

| Invest in foreign stocks |

You can maintain full control on your investments |

| Hong Kong stocks |

Access the greater China market and trade shares from HSBC, Tencent, China Construction Bank, Bank of Communications, Swire and many more |

| US stocks |

Take a direct role in share trading with our transparent market information. Choose the companies you're interested in and make independent investment decisions |

| Invest in foreign stocks |

You can diversify your portfolio |

| Hong Kong stocks |

The HKSE has minimum trading requirements known as 'board lots'. For example, to invest in Tencent you must buy or sell your shares in multiples of 100 |

| US stocks |

US stock exchanges have no minimum board lots, so you can buy or sell 1 share at a time, giving you a great opportunity to enter the market |

- Become a shareholder for market leaders across sectors, such as Google, Apple, Facebook and Johnson & Johnson, with possible annual dividends and bonuses.

- Manage your money easily with transparent prices through multi-asset allocation vehicles. As multinational corporations mostly list themselves on the US and the Hong Kong exchanges, investors can trade in secondary markets and earn capital gains.

- Earn capital gains as stock prices fluctuate during trading in secondary markets.

Place your order through online banking today

Already registered for online banking?

Log on and start trading

Not yet an Internet Banking user?

Register online for Internet Banking services

More ways to trade

Call us

Visit our branches

Find out more information of investment by meeting with our wealth adviser in branch or visit our branch.

Haven't got a account with us yet?

Open a Premier account and experience our quality service.

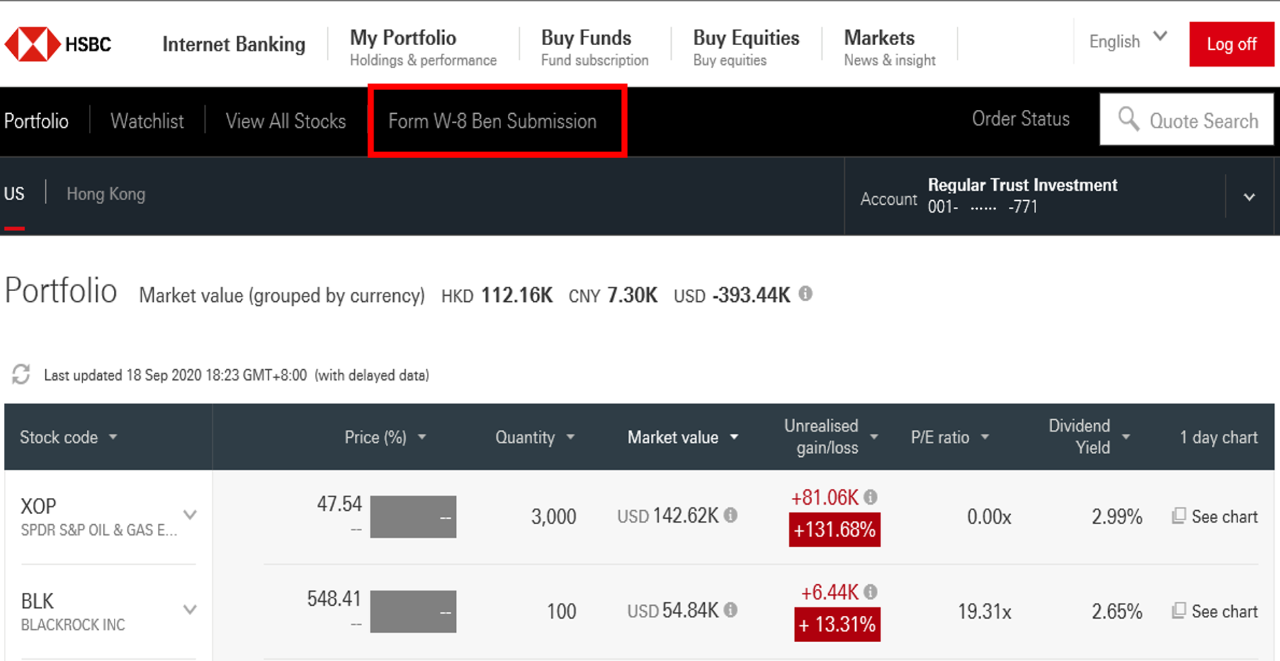

You can also submit W-8 Ben form online

- Submission anytime and anywhere

- Only 5 minutes for form submission

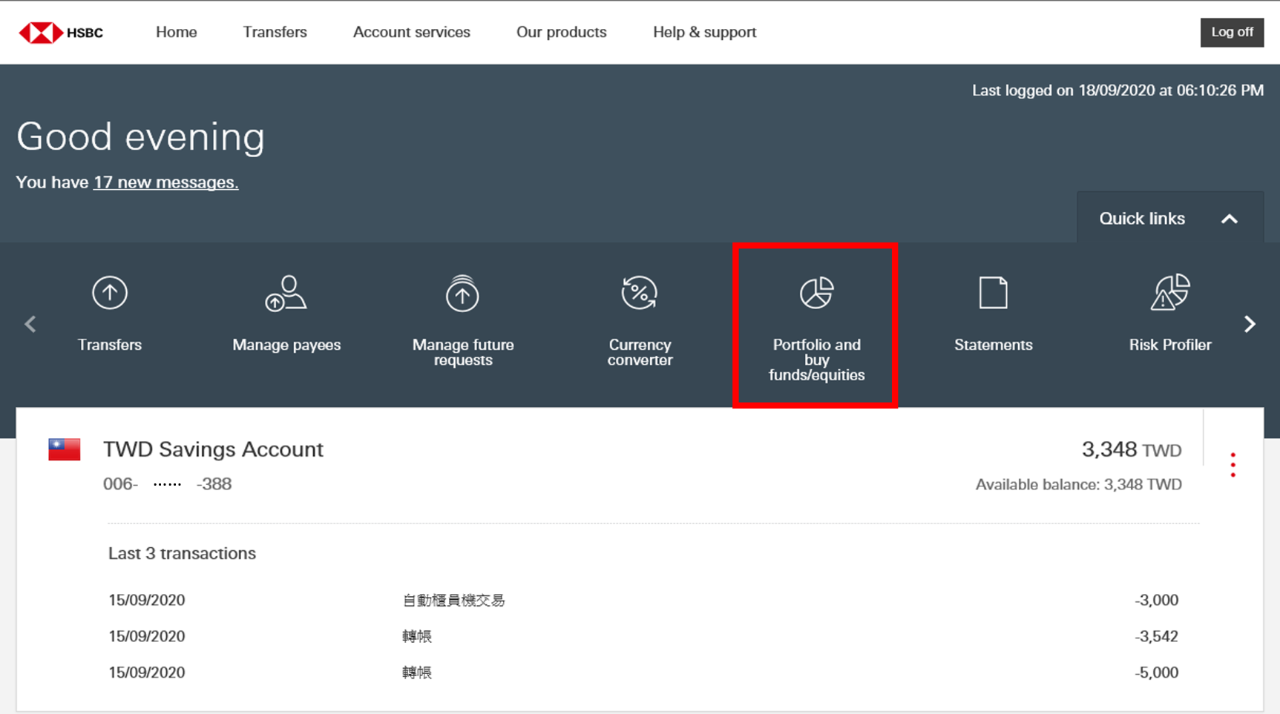

Step 1. Enter personal internet banking and click “Portfolio and buy funds/equities”

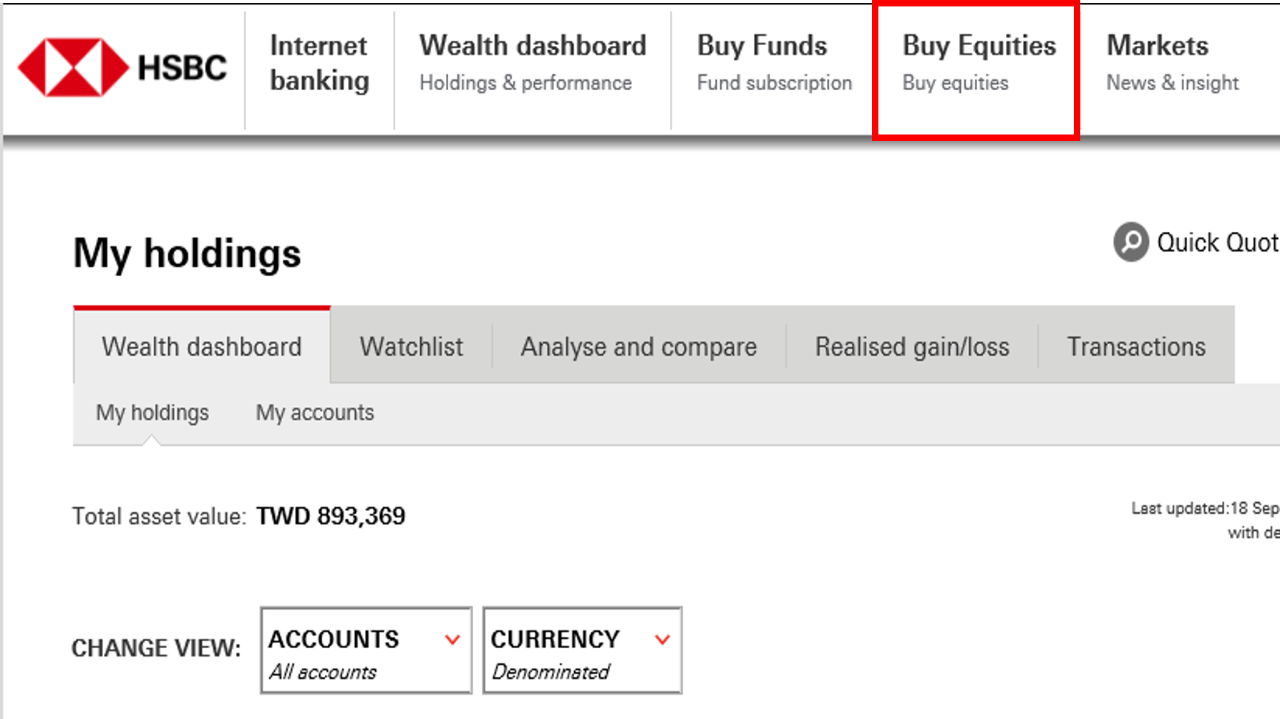

Step 2. Click “Buy Equities”

Step 3. Click “Form W-8 Ben Submission”

You can also submit the complete physical form by:

- handing it to one of our branches

- mailing it to our postal box: Taipei No.167-2617 box (HSBC Bank (Taiwan) Limited

You may also be interested in

i-Invest for online trading

HSBC i-Invest equity trading platform supports you to invest your future. Trade online to enjoy transaction fee discount.

ETFs

Exchange Traded Funds (ETFs) help diversify your portfolio, providing you with a basket of shares so you can catch the latest market trends.