The first step for investment is to understand risk tolerance

The concept of making investments is similar to seeing movies that we pick the ones with ratings suitable for us.

As all investment products have their own risk rating(s), before making investment, it is important to comprehensively understand our own risk tolerance and suitable investment types for finding out the best investment portfolio while enjoying the opportunities of wealth accumulation.

How do I know my risk tolerance?

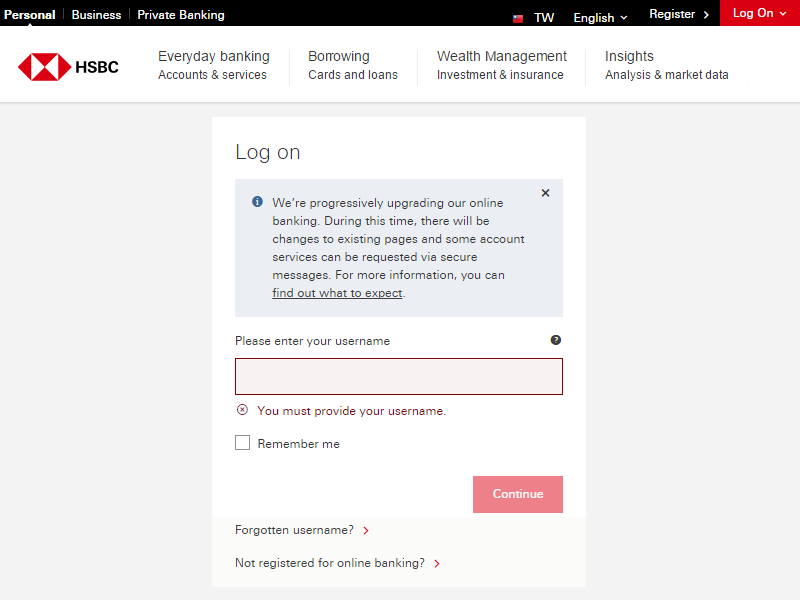

Let’s log on online banking for assessing risk tolerance!

If you have not registered online banking yet, you could register now for assessing risk tolerance!

Assess risk tolerance to find out the best investment portfolio

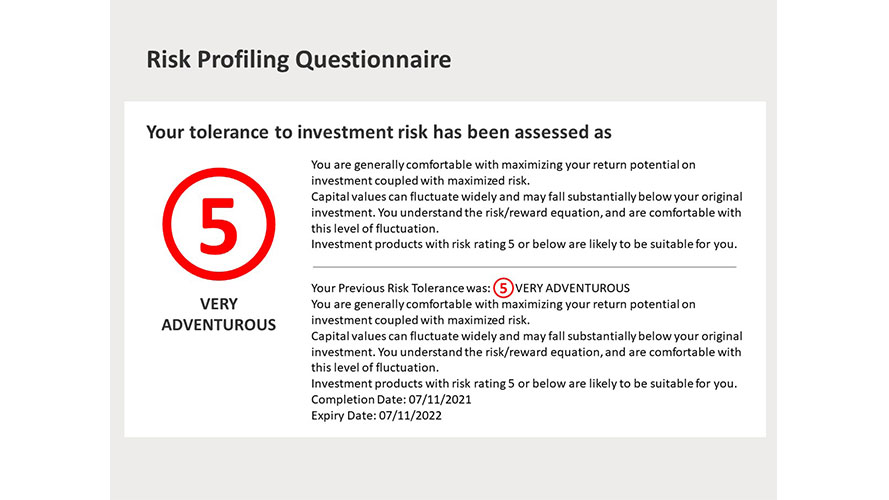

My risk tolerance

Decide to take suitable investment strategies, such as Secure, Balanced or Very Adventurous approach, based on risk tolerance result.

Understand suitable investment type

Set clear investment goal(s) after understanding risk tolerance.

How to determine my risk tolerance

Risk Profiling Questionnaire (RPQ) makes you understand your risk tolerance

Risk Profiling Questionnaire (RPQ) makes you understand your risk tolerance. When you have investment need(s), you need to understand your risk tolerance first. For example, do you prefer to take cautious, Balance or Very Adventurous investment strategy?

Through Risk Profiling Questionnaire (RPQ), we can comprehensively understand investment preference and plan suitable investment portfolio. Let’s log on online banking to assess Risk Profiling Questionnaire (RPQ)!

Log on online banking directly to know what is your risk tolerance?

Log on online banking to understand risk tolerance

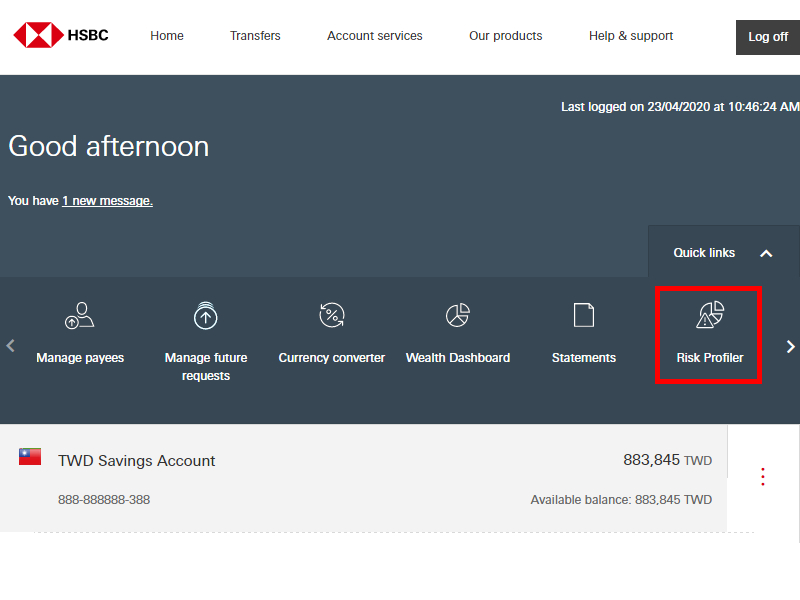

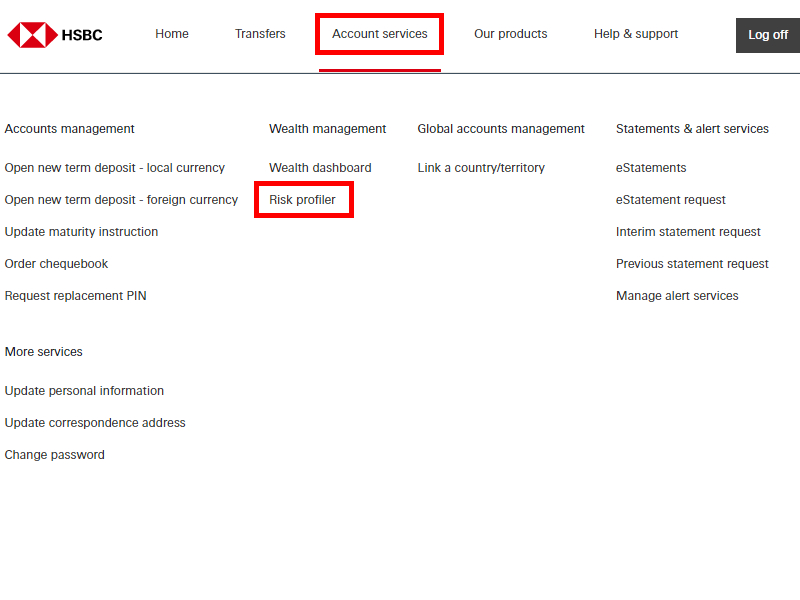

Let’s complete Risk Profiling Questionnaire (RPQ) assessment in 3 simple steps!

Understand the investment type suitable for you

After Understanding your Investment type, setting clear investment goal(s)

After understanding your risk tolerance and investment type, your next step is to set clear investment goal(s) and to find suitable investment product type(s) without getting lost in the market.

Customer Risk Tolerance |

Foreign Stock |

Offshore Bonds | Equity Funds | Balanced Funds | Bond Funds | Dual Currency Investment (DCI) |

Exchange Traded Funds (ETF) |

Interest Sensitive Insurance | Investment-linked Insurance* | Protection Insurance | RiskToleranceDescription |

|---|---|---|---|---|---|---|---|---|---|---|---|

Very Adventurous (5) |

- Be generally comfortable with maximizing return potential coupled with maximized risk. - Be suitable to products |

||||||||||

Adventurous (4) |

|

- Be comfortable with achieving a high level of return potential coupled with high level of risk. - Be suitable to products with quite significant and substantial fluctuation in normal market conditions |

|||||||||

| Balanced(3) | |

- Be generally comfortable with achieving a moderate level of return potential coupled with a moderate level of risk. - Be suitable to products with moderate fluctuation in normal market conditions. |

|||||||||

Cautious (2) |

N/A | |

N/A | |

- Be generally comfortable with achieving a low level of return potential coupled with a low level of risk. - Be suitable to products with low fluctuation in normal market conditions. |

||||||

Very Cautious (1) |

N/A | |

N/A | N/A | N/A | N/A | N/A | -Be generally comfortable with achieving minimal level of return potential coupled with minimal risks. - Be suitable to products with minimal fluctuation in normal market conditions. |

Customer Risk Tolerance |

Very Adventurous (5) |

|---|---|

| Foreign Stock |

|

| Offshore Bonds | |

| Equity Funds | |

| Balanced Funds | |

| Bond Funds | |

Dual Currency Investment (DCI) |

|

Exchange Traded Funds (ETF) |

|

| Interest Sensitive Insurance | |

| Investment-linked Insurance* | |

| Protection Insurance | |

| RiskToleranceDescription |

- Be generally comfortable with maximizing return potential coupled with maximized risk. - Be suitable to products |

Customer Risk Tolerance |

Adventurous (4) |

| Foreign Stock |

|

| Offshore Bonds | |

| Equity Funds | |

| Balanced Funds | |

| Bond Funds | |

Dual Currency Investment (DCI) |

|

Exchange Traded Funds (ETF) |

|

| Interest Sensitive Insurance | |

| Investment-linked Insurance* | |

| Protection Insurance | |

| RiskToleranceDescription |

- Be comfortable with achieving a high level of return potential coupled with high level of risk. - Be suitable to products with quite significant and substantial fluctuation in normal market conditions |

Customer Risk Tolerance |

Balanced(3) |

| Foreign Stock |

|

| Offshore Bonds | |

| Equity Funds | |

| Balanced Funds | |

| Bond Funds | |

Dual Currency Investment (DCI) |

|

Exchange Traded Funds (ETF) |

|

| Interest Sensitive Insurance | |

| Investment-linked Insurance* | |

| Protection Insurance | |

| RiskToleranceDescription |

- Be generally comfortable with achieving a moderate level of return potential coupled with a moderate level of risk. - Be suitable to products with moderate fluctuation in normal market conditions. |

Customer Risk Tolerance |

Cautious (2) |

| Foreign Stock |

N/A |

| Offshore Bonds |

|

| Equity Funds | N/A |

| Balanced Funds |

|

| Bond Funds | |

Dual Currency Investment (DCI) |

|

Exchange Traded Funds (ETF) |

|

| Interest Sensitive Insurance | |

| Investment-linked Insurance* | |

| Protection Insurance | |

| RiskToleranceDescription |

- Be generally comfortable with achieving a low level of return potential coupled with a low level of risk. - Be suitable to products with low fluctuation in normal market conditions. |

Customer Risk Tolerance |

Very Cautious (1) |

| Foreign Stock |

N/A |

| Offshore Bonds |

|

| Equity Funds | N/A |

| Balanced Funds | N/A |

| Bond Funds | N/A |

Dual Currency Investment (DCI) |

N/A |

Exchange Traded Funds (ETF) |

N/A |

| Interest Sensitive Insurance | |

| Investment-linked Insurance* | |

| Protection Insurance | |

| RiskToleranceDescription |

-Be generally comfortable with achieving minimal level of return potential coupled with minimal risks. - Be suitable to products with minimal fluctuation in normal market conditions. |

Please be minded that this table is only for reference. As each product type may cover a range of different risk ratings, the bank will only provide a range of products suitable to customers’ risk tolerance. In addition, the table above does not consider products for Professional Investors (PI).

The three categories of funds/Unit Trusts (UT) listed above are not covering all categories in the market. Different categories include products with various risk rating.

*The underlying in investment-linked insurance should match with customer risk tolerance.

You might be interested in

Unit trusts Investments

Make your investment more diversified to your portfolio. With HSBC, you can choose from a wide range of funds to match your attitude to risk and investment goals.

Foreign stocks

Become a shareholder of major companies across various sectors to receive dividends, enjoy the growth, or gain returns from trading volatility.

Exchange Traded Funds (ETF)

Allocate your wealth to a batch of securities in one transaction to enable the grasp of growth opportunities in a specific market or industry while diversifying your investment portfolio.

Offshore Bonds

Make steady and consistent source of income/coupons and allocate your wealth in a comparatively stable asset for the opportunity to diversify investment risk.

Dual Currency Investments (DCI)

Target a variety of real time quotation in foreign currencies to attain your personal goal in wealth management.

Structured Deposits

Capture opportunities from market with tailor-made product features to match your financial aspiration.

Log on online banking or visit a branch to understand investment risk tolerance

- Existing customer ?If you already invest with HSBC, just log on to browse, buy and sell funds.

- Not yet a customer?If you have not applied for online banking, you can also register online and get the fund subscription discount.