New Function Released- Trade Equities/ETF via mobile banking

Stay on top of market volatility anytime, anywhere and never miss any investment opportunity

Three steps and 30 seconds to swiftly place a stock/ETF order

Trade Equities/ETF via HSBC TW APP in 3 steps

【Three steps and 30 seconds to swiftly place a stock/ETF order】

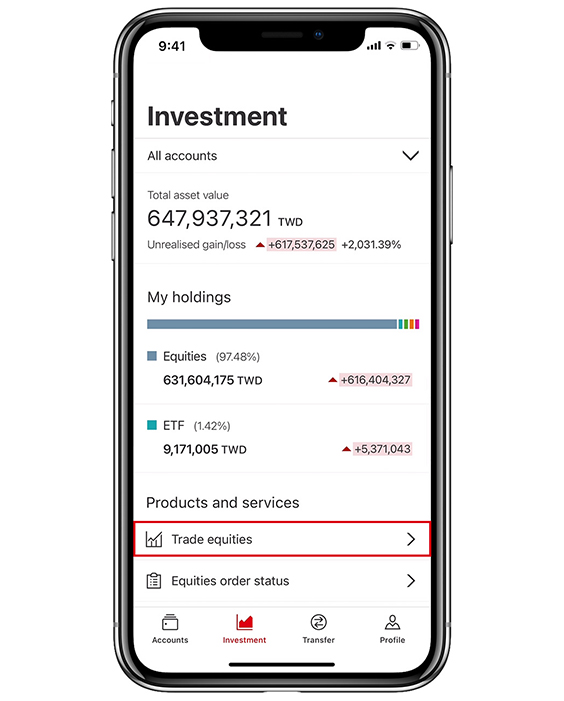

Step 1. Log on to Mobile Banking and access to ‘Investment’ page under products and services page

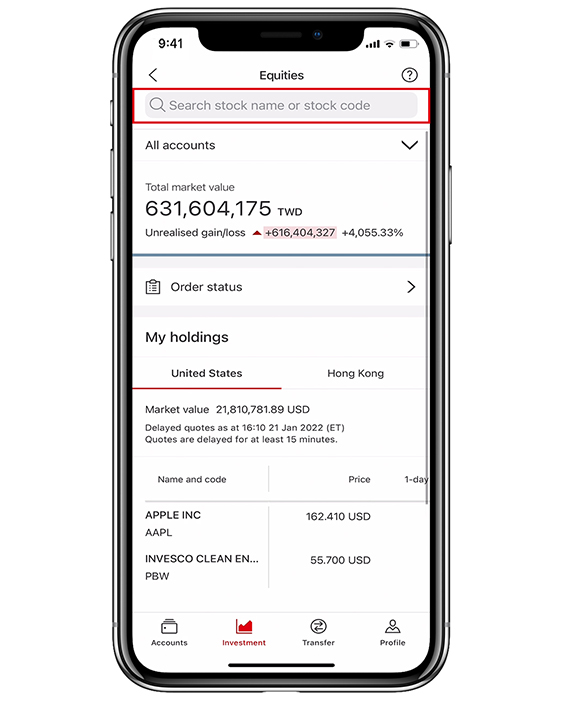

Step 2. Please tap on ‘Stock Trading’ and search for the corresponding product on the top searching bar

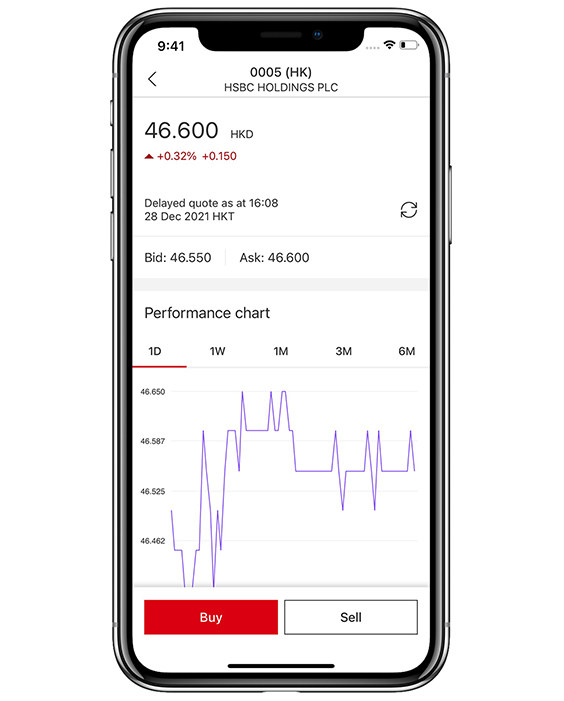

Step 3. Reach product page and Select ‘Buy’ and enter the quantity/price to be traded

【Download HSBC (Taiwan) App now】

Access global market information with our easy investing tools 'i-Invest platform'

Many people are looking to invest in dividend-yielding thematic equities and ETFs.

Looks at the stock industry and the ETF subject quickly

Intra-day Trading in US Equities

What does “Intra-day Trading in US Equities” mean?

Intra-day Trading in US Equities provides investors the flexibility to buy in and sell stocks within trading hours on the same day. You can close your position and gain profit right after you bought it to avoid potential market risk.

We support intra-day trading in US equities, which provides a more efficient way of capital utilization.

• Your holding will be updated immediately in your online banking account

• The same stock can be bought in again right after it was sold with no limit of the transaction times

Three points make HSBC i-Invest best partner for your global investment

【Instant】

24 HR links to the exchanges.

【Fast】

3 steps to place an order.

【Simple】

All investment portfolio in one account.

Become an international company shareholder

Invest without any barriers

Comprehensive investment account

- More than 2,000 stocks and ETF

- 24 HR equity trading

- Customized news screening

- Multiple product performance comparison

-

Trade Equities/ETF via mobile banking

- Instant order execution information

- 14 days maximum order

- Set historical price in one click

- Watch list setting to monitor the price

- All in one account with cash deposit and investment

- No need to transfer money

- Overall wealth management in one account

Trade online with i-Invest to enjoy at least 0.35% transaction fee*

Period: 2023/10/1-2023/12/31

Target Customers: All HSBC Bank customers

*Discount on transaction fee: Trade overseas stocks and ETFs through HSBC i-invest platform, if the transaction amount of a single transaction is greater than or equal to USD 50,000/HKD 400,000/RMB 400,000, the transaction fee is 0.35%; If the transaction amount is less than USD 50,000/HKD 400,000/RMB 400,000, the transaction fee is 0.45%. If the transaction amount does not meet the minimum transaction fee, the Bank will still charge a minimum fee of USD 30, HKD 250 or RMB 250. The charging method of overseas stocks/ETFs will be subjected to the relevant regulations of the Bank.

Diversify your portfolio

Steady but rewarding equities

Real estate and public utilities ETFs benefit from a low interest rate environment, and the steady profit and high dividends typically generated make these a top choice for those who are looking to make medium to long term investments.

The healthcare industry

The flurry of activity including the manufacturing of pharmaceuticals and the mergers of biotechnology and medical companies, have created no shortage of opportunities. Stocks in this industry are heavily favoured by investors for their potential to grow.

The tech industry

US tech stocks continue to reach new heights, thanks to developments in artificial intelligence (AI), Big Data, Cloud Computing, Driverless Cars, and the rise of 5G technology. As such, investors may wish to pay close attention to emerging science and technology trends when selecting stocks to purchase.

The retail industry

Investing in consumer products and services - whether it be in food and beverages, fashion, real estate, automobile, travel, hospitality, technology or communications - can be a good option for setting your investment portfolio up for success.

Trade with i-Invest in 3 steps

Log on to Internet Banking to invest in U.S and Hong Kong stock markets and ETFs anytime, anywhere.

Step 1

Search and select stock

Step 2

Confirm price, number of shares and date

Step 3

Order completed

Access 24-hour global market information and to keep you informed in US and Hong Kong stock markets

Convenient ordering to save you time and money. Under set up one time order, longest on 14 BD effective

View historical candlestick charts to help determine your ideal order prices

For grasping the tendency as necessary, make your own personalized watch list to analyze the latest trends

Start trading now

Existing customer ?

Already registered for online banking?

Not yet a customer?

If you have not applied for online banking, you can also register online and enjoy the offers.

Other way to place the order

New customer?

Welcome to apply for the HSBC Premier Banking Account and enjoy the banking and wealth management services provided by Premier Banking.

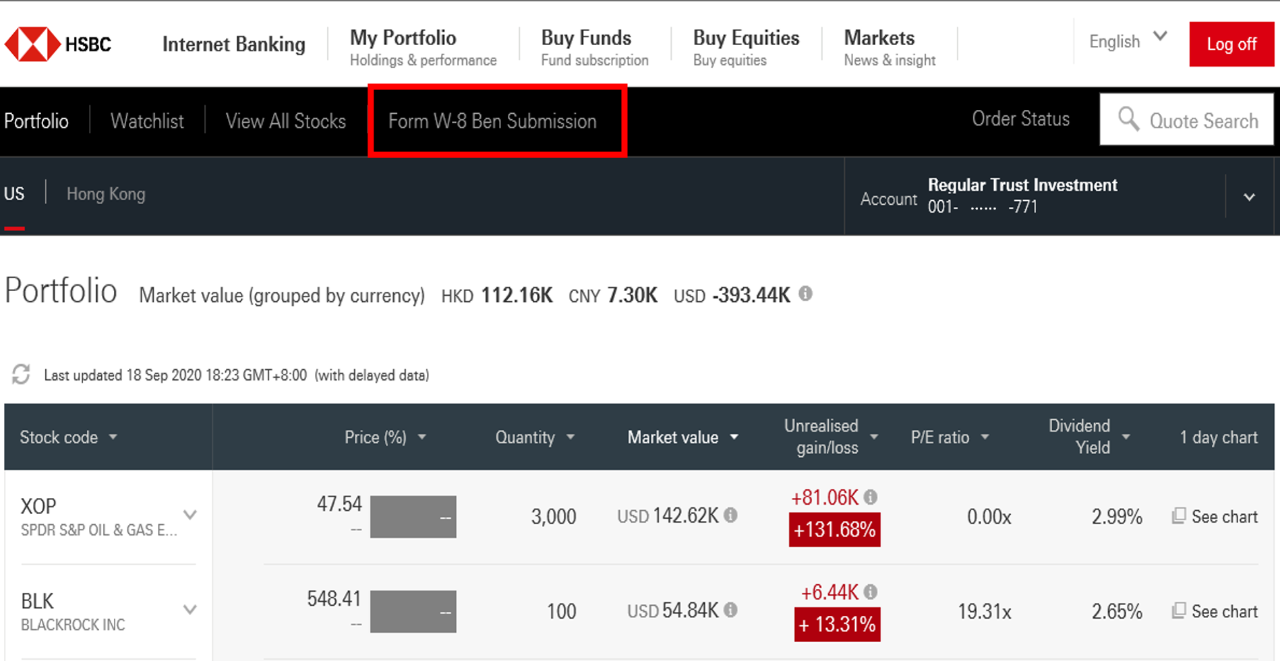

You can also submit W-8 Ben form online

- Submission anytime and anywhere

- Only 5 minutes for form submission

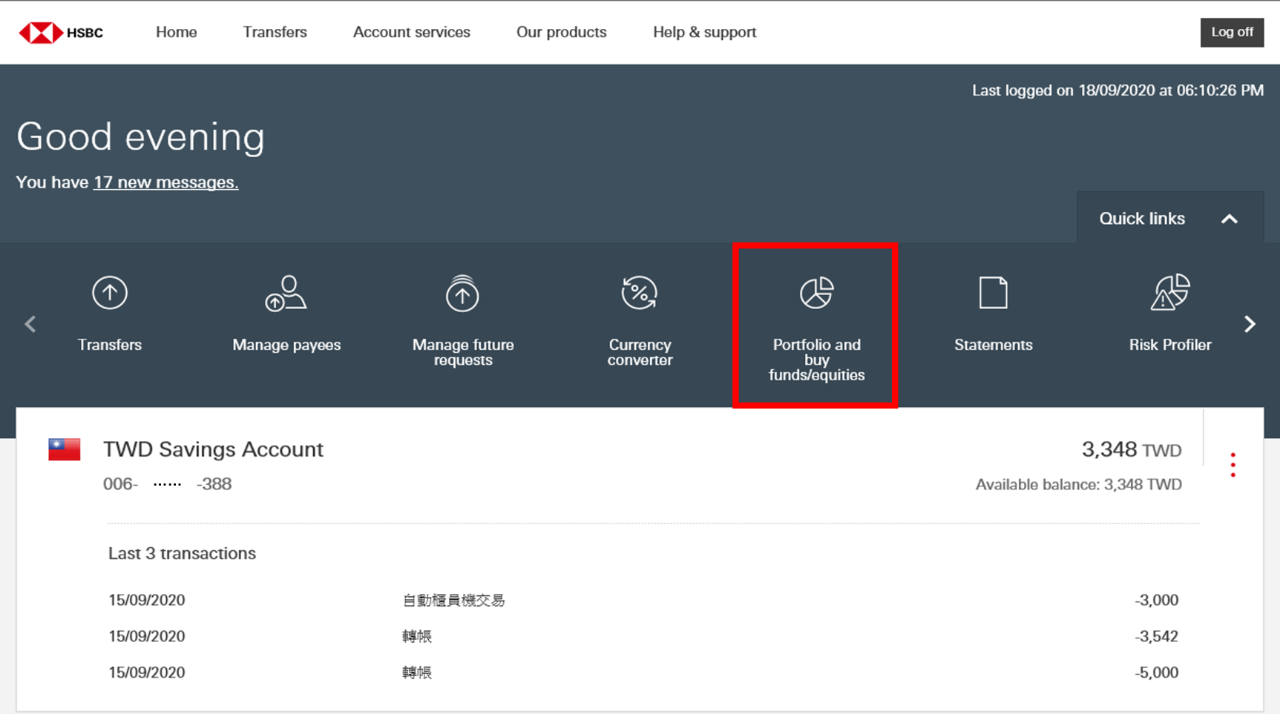

Step 1. Enter personal internet banking and click “Portfolio and buy funds/equities”

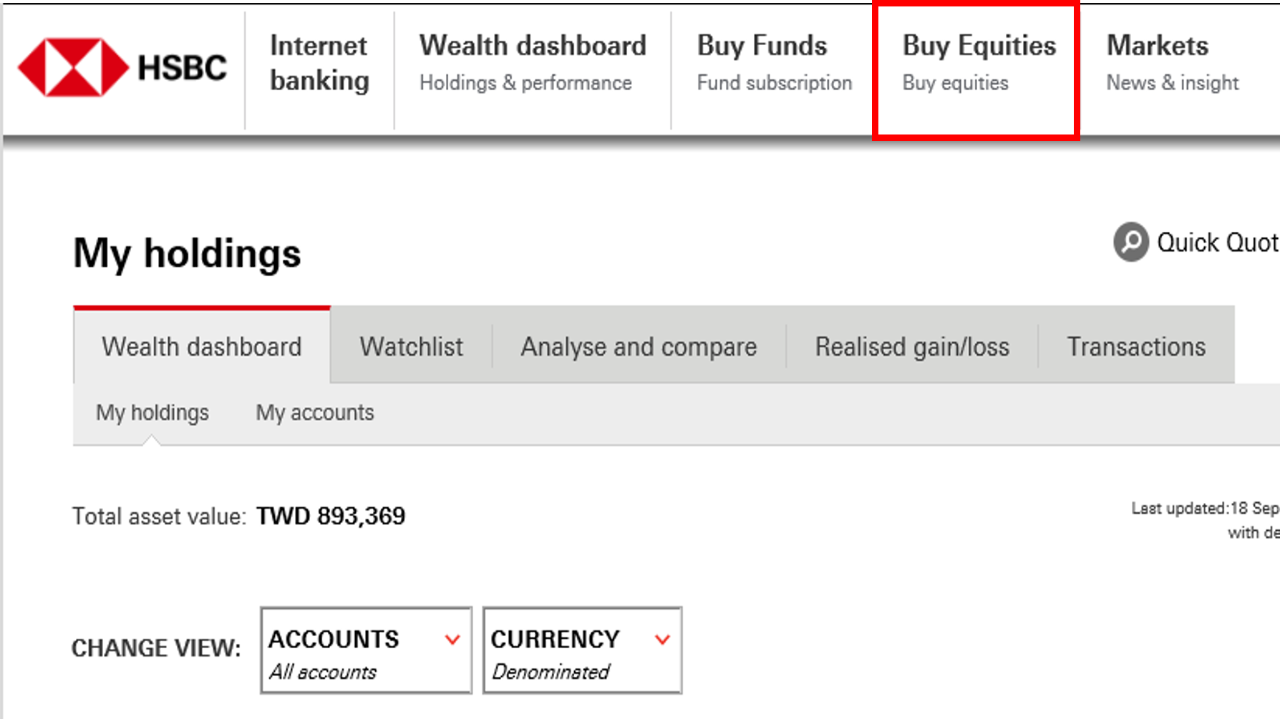

Step 2. Click “Buy Equities”

Step 3. Click “Form W-8 Ben Submission”

You can also submit the complete physical form by:

- bringing it to one of our branches

- mailing it to our postal Taipei No.167-2617 box (HSBC Bank (Taiwan) Limited)

If you have any questions about the function or operation of our i-Invest stock/ETF trading platform, please contact your wealth adviser or call us at +886 2 6616 6000.

You may be interested in

Foreign stocks

Become a shareholder of major companies across various sectors to receive dividends, enjoy the growth, or gain returns from trading volatility.

ETFs

Exchange Traded Funds (ETFs) help diversify your portfolio, providing you with a basket of shares so you can catch the latest market trends.