HSBC Taiwan Credit Card System has been upgraded (Update date: 2024/4/29)

Dear HSBC cardholders:

Our credit card system has been upgraded on April 29 to enhance our service in Taiwan, which brings you more diverse and convenient credit card service. Through the brand-new credit card online services, where you can check the consumption status of your credit card anytime and anywhere, making you more convenient on credit card use.

The old version of credit card online service has been no longer supported by our system, therefore, we welcome you to register our brand-new credit card online service to have the new experience!

Integration with digital services

The new Internet Credit Card Service consolidates existing digital services, allowing you to easily manage credit card functions.

Security upgrade for internet credit card and voice services

Your HSBC credit cards will have better card security after our system upgrade.

Shared credit limit

Multiple HSBC credit card limits are shared, while billing remains independent, offering you maximum flexibility for card usage and payments.

Integration with digital services(Update date: 2024/4/29)

Take advantage of diverse functions watch video

The upgraded HSBC credit card online services provide you with a more integrated, convenient and secure credit card digital platform.

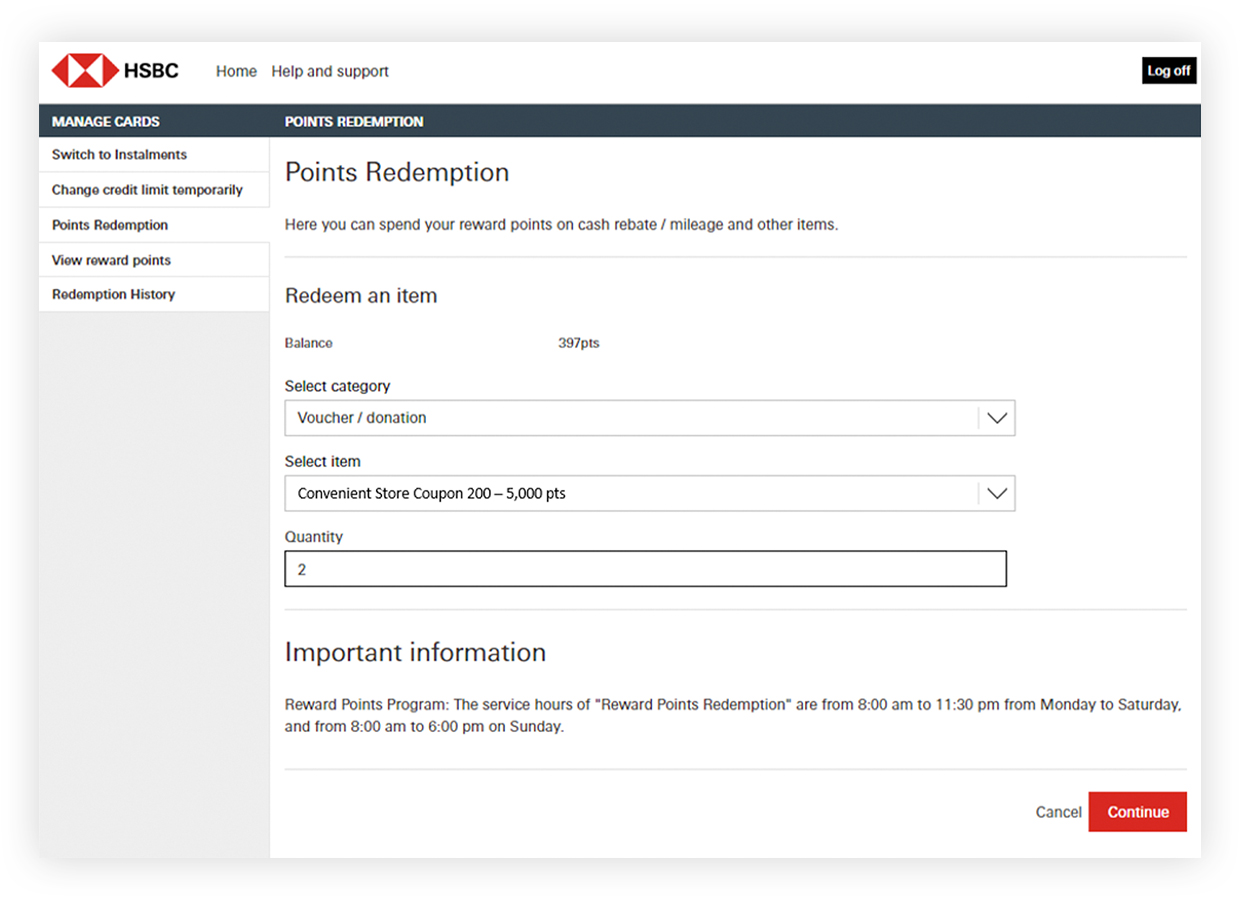

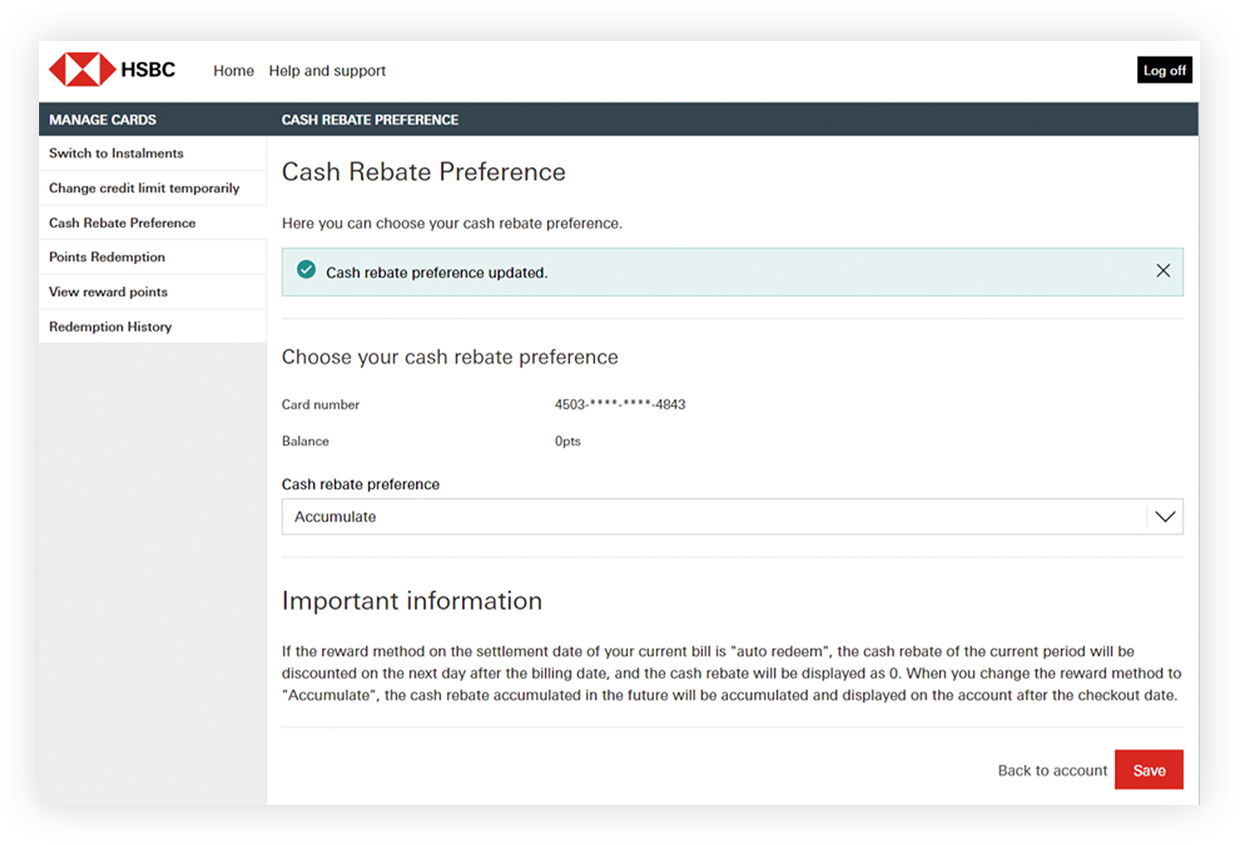

All-in-one credit card digital platform

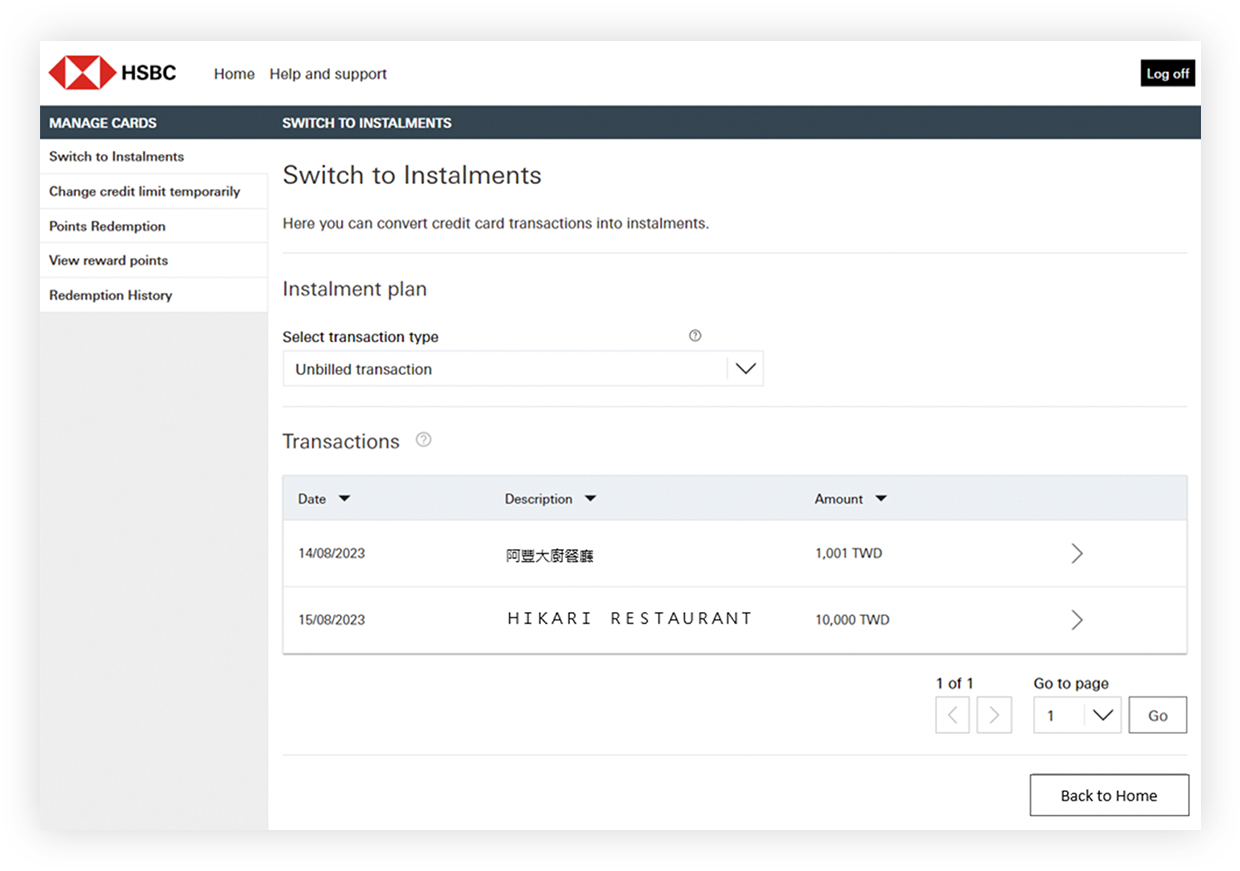

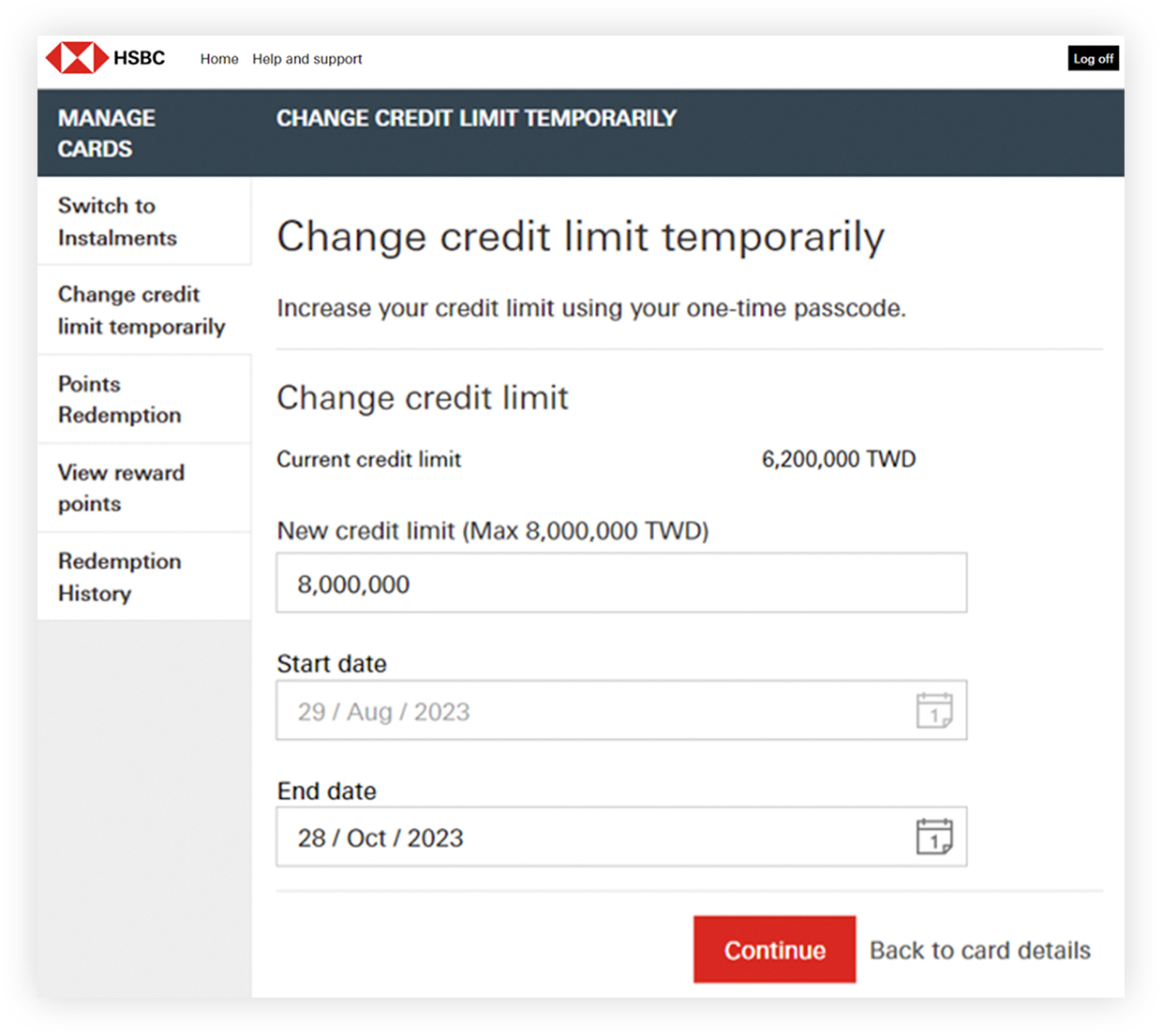

- No need to log on to multiple platforms back and forth; the new HSBC Internet Credit Card Service offers functions including instalment payment applications, points redemption, temporary credit limit adjustments, and more.

Enjoy convenience on the go

- Bilingual support: all credit card digital services are available in both Traditional Chinese and English, catering to the language preferences of customer.

- Responsive web design: the upgraded credit card online service can fit various screen sizes, offering the best visual experience.

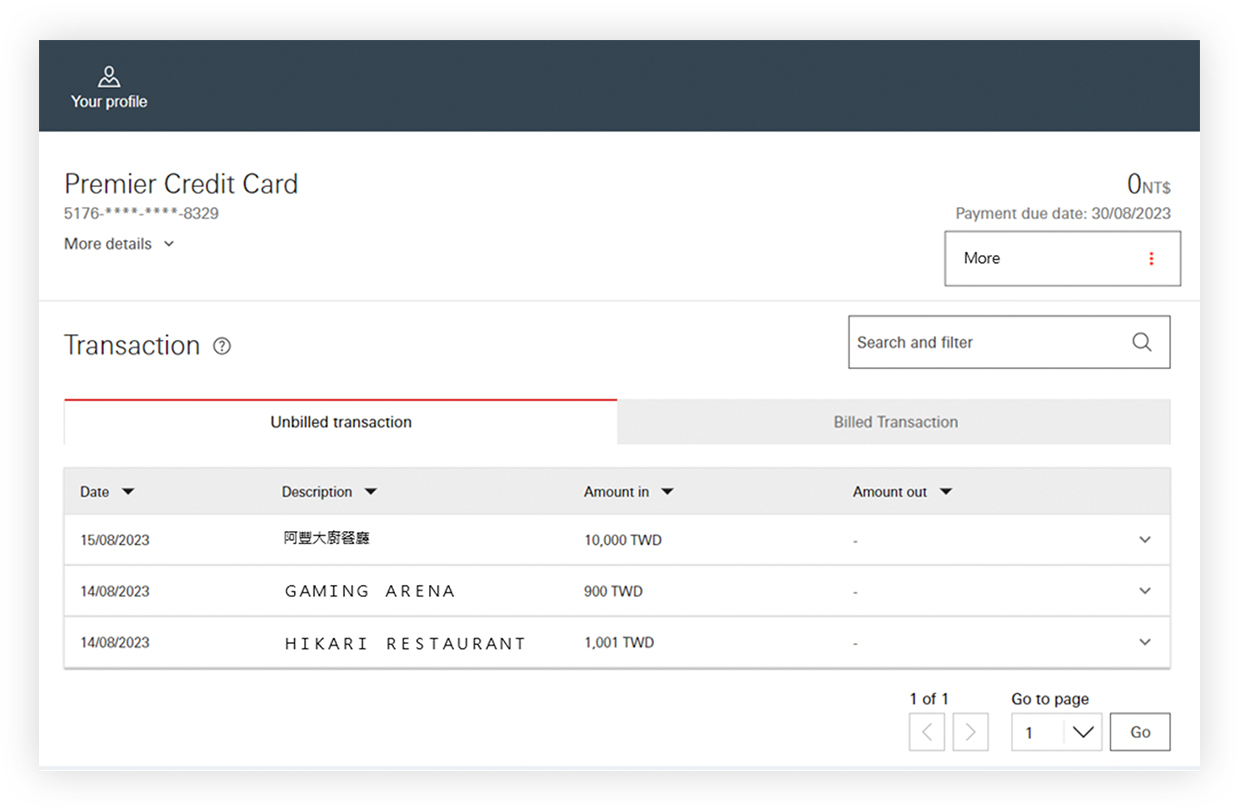

Introduction to credit card online services and features

The brand new Internet Credit Card Service focuses on your needs, aiming to offer more enhanced and integrated digital experience.

For more upgraded HSBC credit card online services, click here

Secure and convenient internet credit card and voice services

Secure and convenient internet credit card and voice services watch video

1. Introduce more convenient log on method and upgraded password strength, providing a secure online experience.

For more upgraded HSBC credit card online services, click here

Please note: For more secured and convenient banking experience, both new and existing users will need to re-register for the new Internet Credit Card Service accounts due to the enhanced security measures.

2. Your credit card voice services will now use SMS dynamic authentication password (one-time password) for identity verification instead of the original voice password. You don't need to worry about forgetting or losing your password.

As the verification will be changed to SMS dynamic authentication password, please make sure you have updated your mobile number registered with HSBC.

Flexible card spending and convenient point redemption

Easy credit limit sharing and consumption with one card

Our system upgrade will combine the credit limits of all your HSBC credit cards to give you greater flexibility in managing your card spending and enjoying card benefits.

You can make purchases via shared credits with HSBC Cashback Signature Credit Card or Cashback Business Titanium Credit Card to accumulate cashback points more easily, which can be used to offset your bill payments. If you hold an HSBC Traveller's Card, you can earn travel points that can be exchanged for miles with multiple airlines more quickly, and enjoy benefits such as airport transfers, airport lounges and travel insurance if eligible.

From now on, you can apply for different HSBC credit cards based on your spending habits and the benefits you want to enjoy. You can flexibly use your cashback points or travel points.

*Your available credit limit will be determined by deducting the total spent amount/outstanding balance of all credit cards under your name from the credit limit at the time of the credit card transaction.

Improved calculation in reward point expiry

The expiry dates for reward points will now be calculated separately on a rolling basis, giving you with more flexibility in point accumulation.

- Before upgrade - all points will be reset to zero on the expiry date regardless of each consumption/earning date

- After upgrade - points will expire based on the date those points are earned

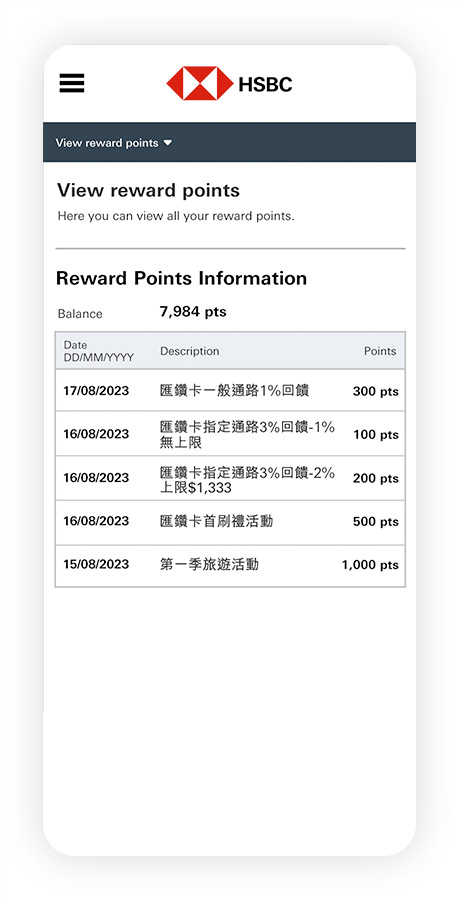

Reward points summary by purchase

All accumulated reward points from your purchases are now clearly calculated for you!

Points are calculated based on the total consumption amount for each campaign category in each period, and a breakdown of reward points for all campaigns in the period will be provided on the billing date.

For example:

- Mr. Wang's consumption amount with Cashback Business Titanium Credit Card is as follows:

-Total amount of consumption through general channels is TWD30,000, and he can gain 1% rebate from general channels, which is TWD30,000 x 1% = 300 points

-Total amount of consumption through designated channels is TWD10,000, then he can gain following rebates from designated channels

* 1% rebate from designated channels, which is TWD 10,000 x 1% = 100 points

* Extra 2% rebate from designated channels, which is TWD10,000 x 2% = 200 points

* Qualified for the Cashback Business Titanium Credit Card campaign of first-consumption with 500 points gained

* Qualified for the 1Q-travel campaign with 1,000 points gained

Frequently asked questions (FAQ)

Credit card statements and payments

Credit card auto-bill payments

Shared credit limits and limit adjustments

Internet Credit Card Service

Click me to Credit Card Internet Service

Credit card reward points

Credit card voice services

Credit card instalment services

Credit card mobile payments

Credit card other services

Please manage your finances carefully and value your credit

Interest on revolving credit and cash advance 5.68% to 15.00%. Service Charges for cash advance NT$100 + the amount of cash advance * 3.5%. Base date of interest on revolving credit: September 1 2015.