Track specific industry or market to catch the potential for growth

ETF offers you to allocate wealth in specific industry or market while capturing the overall market tendency in one transaction.

Why invest in ETFs?

Exchange traded funds offer several key benefits:

- Straightforward returnsAn ETF is often linked to an exchange index. So the return is linked to the overall performance of the index rather than a specific stock or share in it

- Diversification built-inAn ETF tracks the complete portfolio of an index, so your investment doesn't rely on a single stock or share's performance

- Global reachAn ETF can cover equity, bond markets and all industries worldwide, which gives you access to global asset allocation

- Trade quickly and convenientlyETFs have high liquidity. They're traded on renowned securities exchanges worldwide like the NYSE. Trading time is flexible and trade volume is often high

- Low transaction costAn ETF doesn't need a fund manager and research team to manage the portfolio. So the management fee is relatively low. You also won't need to frequently trade individual stocks to get capital gains, so taxes and service charges are effectively reduced

- Know what you're gettingThe portfolio of an ETF is identical to the portfolio of the index that it tracks, so it's highly transparent

- Passive managementAn ETF is traded in the same way as a stock. It is traded on the securities exchanges. It doesn't have a fund manager overseeing its portfolio

Types of ETFs

Tracking

This type of ETF tracks specific indexes, including stock indexes, industry indexes and country/territory indexes. This type of ETF tracks the target indexes through replication or sampling. When the components or proportion of the linked index changes, the manager will adjust the portfolio of the ETF by adjusting the component stocks or weight. Adjustment is usually made at regular intervals, unlike a unit trust fund that is adjusted frequently.

Basket

More commonly known as HOLDRS (Holding Company Depository Receipts), this is not a true ETF but has similar characteristics. Unlike a tracking ETF, its portfolio is static. Once the stock components are bundled together by a fund manager, no new stock will be introduced to the same basket. Usually this type of fund focuses on a particular industry.

ETF returns

There are a few ways to make money investing in ETFs:

- Capital gainsCapital gain is the primary source of income for an ETF. Since an ETF invests in different types of stocks, it may earn a spread from buying low and selling high

- Dividend incomeWhenever the stocks that make up the ETF pay out dividends, investors are entitled to their share of dividend income, minus any management fees or applicable taxes

- Exchange gainIf you invest in an ETF in a foreign currency, you may make money in the exchange rate when you sell it

| Comparison Table | ETF (Passive Management) | Unit Trusts (Active Management) |

|---|---|---|

| Objective | Fully replication | Optimization |

| Cost | Low management fee and transacation cost | High management fee and high turnover rate |

| Transparency | High, easy to supervise | Low (Difficult to learn the portfolio) |

| Diversify | High | Low |

| Asset Allocation | Clear and accurate | Control by fund manager |

| Tracking error | Low | High |

| Comparison Table | Objective |

|---|---|

| ETF (Passive Management) | Fully replication |

| Unit Trusts (Active Management) | Optimization |

| Comparison Table | Cost |

| ETF (Passive Management) | Low management fee and transacation cost |

| Unit Trusts (Active Management) | High management fee and high turnover rate |

| Comparison Table | Transparency |

| ETF (Passive Management) | High, easy to supervise |

| Unit Trusts (Active Management) | Low (Difficult to learn the portfolio) |

| Comparison Table | Diversify |

| ETF (Passive Management) | High |

| Unit Trusts (Active Management) | Low |

| Comparison Table | Asset Allocation |

| ETF (Passive Management) | Clear and accurate |

| Unit Trusts (Active Management) | Control by fund manager |

| Comparison Table | Tracking error |

| ETF (Passive Management) | Low |

| Unit Trusts (Active Management) | High |

Things to know

- All money you invest in ETFs is an investment, not a deposit. Therefore, your money isn't protected by the Central Deposit Insurance Corporation (CDIC).

- Remember when choosing ETFs that past performance doesn't guarantee future performance. The price of the ETF may fluctuate. The value of your investments could go down as well as up. And you could get back less than you invested.

- While you have no risk in individual stocks, you still have to assume market risk.

- It is impossible for an ETF to fully replicate or track the indexes like-for-like.

- The method of an ETF trade is the same as a stock trade. Whenever there is a significant event in the market, you may be unable to subscribe or sell your ETF.

- If the underlying currency of an ETF strengthens, you will get an exchange gain. If it weakens, you will suffer exchange loss.

- Determinants of “ETF” prices

The prices of ETF are determined by the trading value of the specific indexes contained in the portfolios plus any unpaid income. - Performance of ETF

Return of Investment is the most direct way to assess the performance of ETF, and the equation for calculation is shown below:

{[(the most recent price of the ETF - the subscription price of the ETF) + dividends paid out from the index stocks contained in the portfolio] ÷ the subscription price of the ETF}×100%. - Currency for ETF Trade

The currency for ETF trade shall be determined by the exchange of the country/territory where the ETF is registered. - Transaction fee charges of ETF

Charges may be applied to the subscription or holding of ETF, including subscription fee, redemption fee, custodian fee, and any required charge by exchange etc. Charges resulting from ETF trade itself such as the custodian fee of the custodian bank and miscellaneous expense will be internally deducted. Investors are not required to make extra payment. Related fee information, please refer to the fund prospectus. - Basis of ETF price

This instrument is traded in offshore exchanges. The execution and confirmation of trade shall be based on the trading hours at the place of trade. As such, the price of this instrument may be determined only on the business day after the execution of trade due to different time zones. The product’s execution price should be confirmed when the bank receives the transaction confirmations from the counterparty. - Applicable tax code to ETF

The tax law of the USA requires that non-US nationals who have incomes, including cash dividends and others, inside US territory be subject to a 30% of withholding tax. This taxation standard may vary with the content of the trade or changes in the market. - “Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

Place your order through online banking today

Already registered for online banking?

Log on and start trading

Not yet an Internet Banking user?

Register online for Internet Banking services

More ways to trade

By phone

Call (02)6616-6000

In branch

Find out more information of investment by meeting with our wealth adviser in branch or visit our branch.

Not an HSBC customer?

Discover exclusive offers and preferential pricing for HSBC Premier customers.

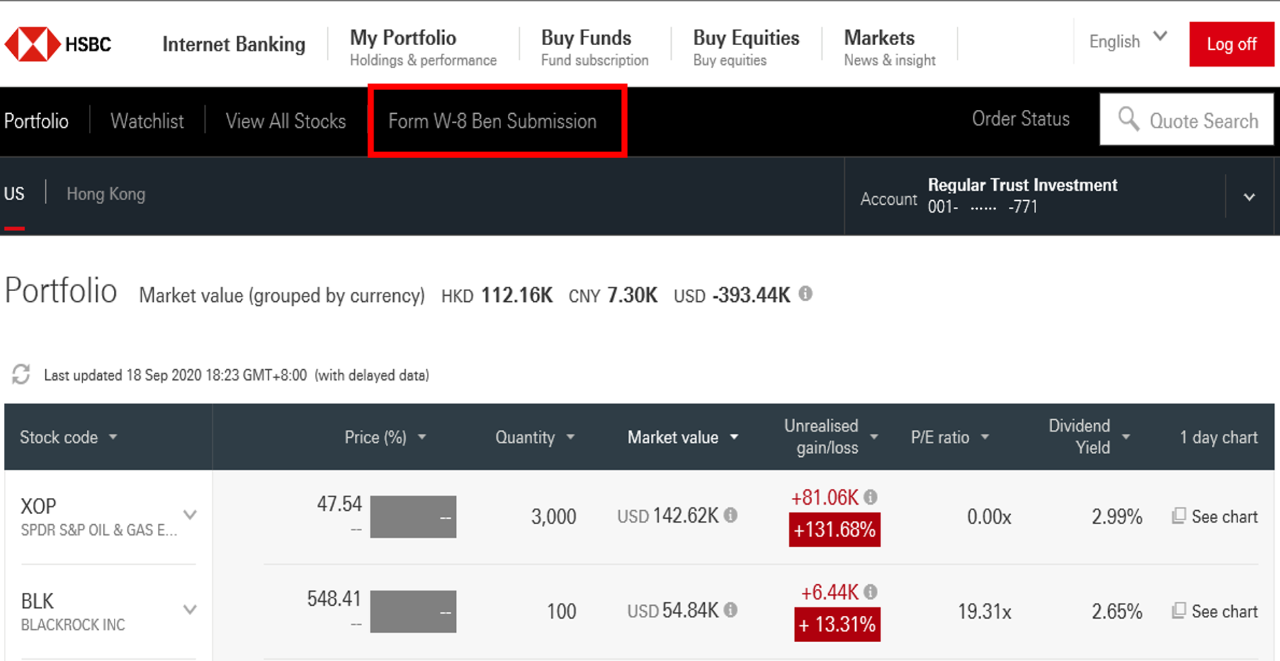

You can also submit W-8 Ben form online

- Submission anytime and anywhere

- Only 5 minutes for form submission

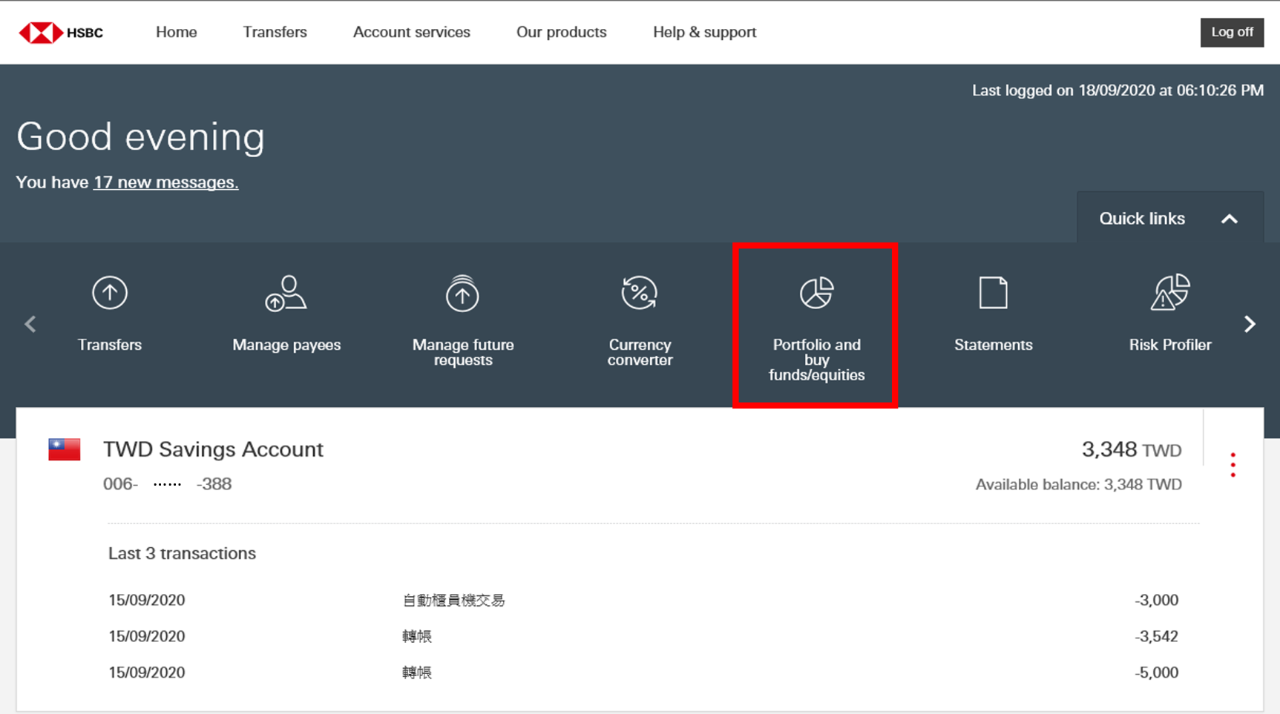

Step 1. Enter personal internet banking and click “Portfolio and buy funds/equities”

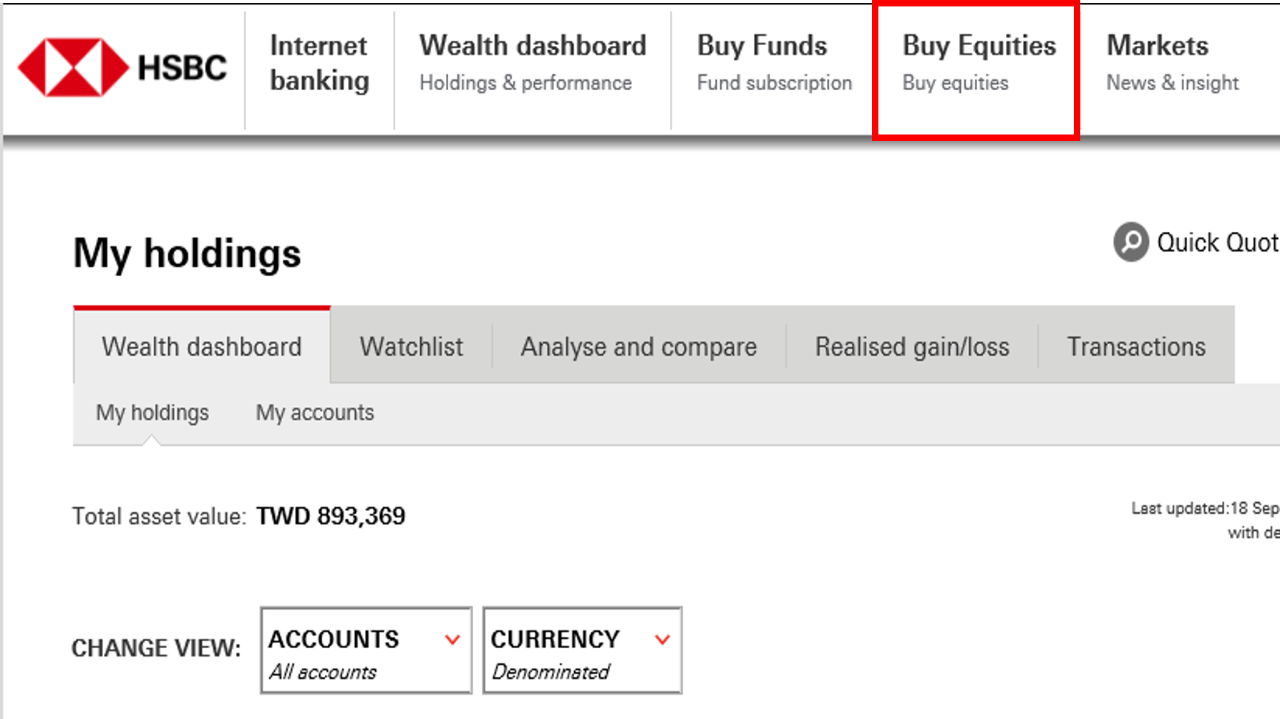

Step 2. Click “Buy Equities”

Step 3. Click “Form W-8 Ben Submission”

You can also submit the complete physical form by:

- bringing it to one of our branches

- mailing it to our postal box: Taipei No.167-2617 box (HSBC Bank (Taiwan) Limited

You may also be interested in

i-Invest for Online Trading

HSBC i-Invest equity trading platform supports you to invest your future. Trade online to enjoy transaction fee discount.

Foreign stocks

Become a shareholder of major companies across various sectors to receive dividends, enjoy the growth, or gain returns from trading volatility.