Subscribe Unit Trusts online or via mobile APP and get 40% to 70% reduction in fees.

- Period : 2025/01/01-2025/06/30

- Target Customers: All HSBC Bank customers

- Special subscription fee offer via online banking: Monthly Investment Plan for 70% off and Lump Sum for 40% off in campaign period.

HSBC fund list

Trade UT via HSBC TW APP in 3 steps

【Three steps and 30 seconds to swiftly place an UT order】

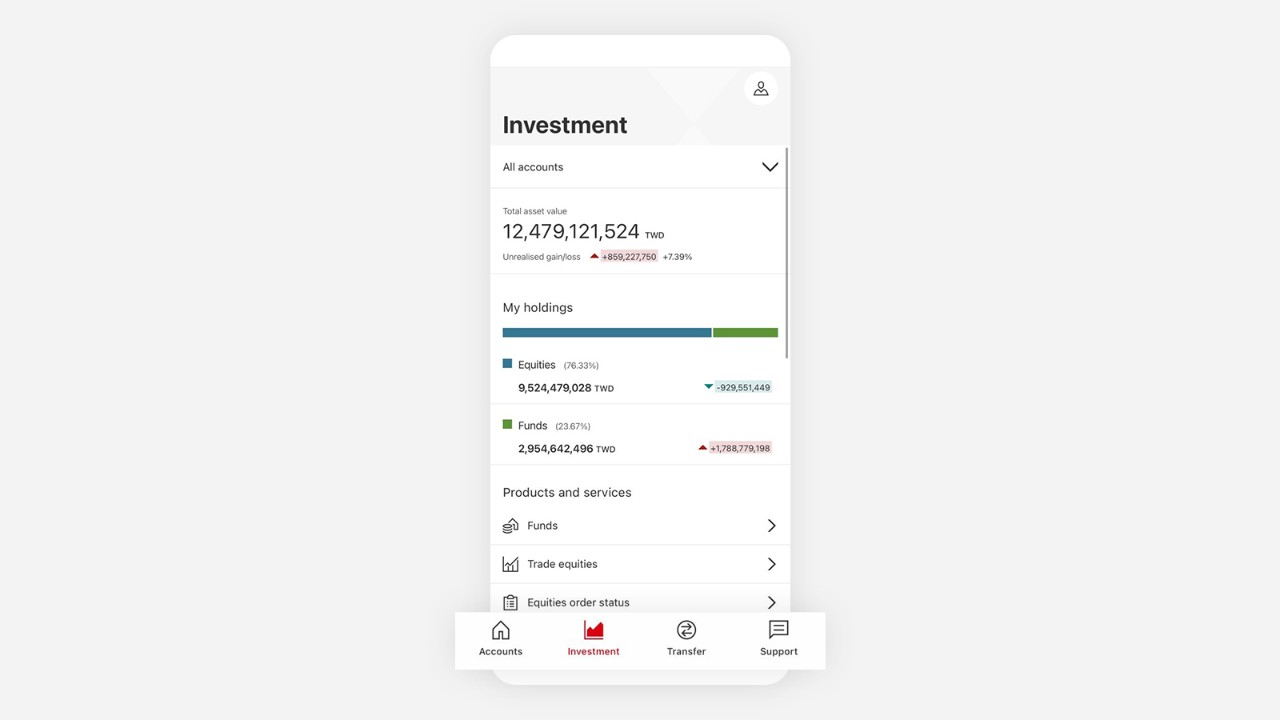

Step 1. Log on to Mobile Banking and access to ‘Investment’ page under products and services page.

Step 2. Please tap on ‘Funds’ and click on ‘Explore funds’, then search for the corresponding product on the top searching bar.

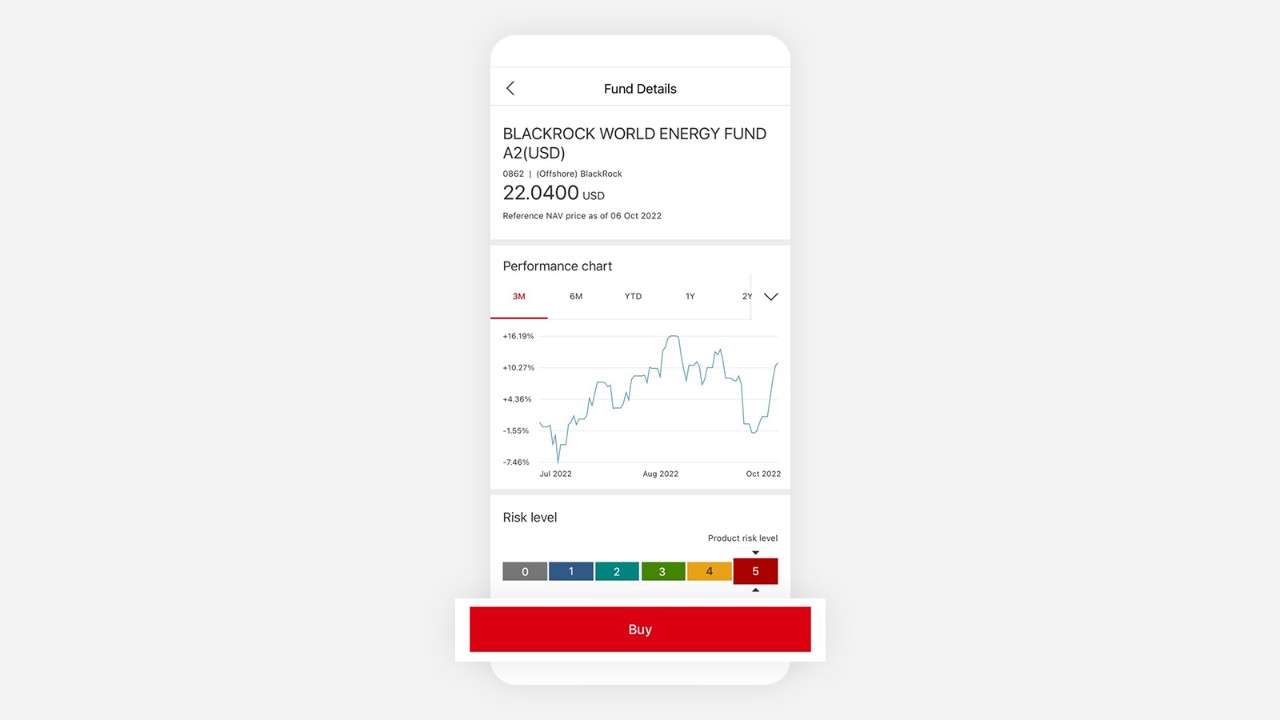

Step 3. Research product page and select ‘Buy’ and enter the transaction details.

Fund comparison feature

【Three steps and 30 seconds to compare funds】

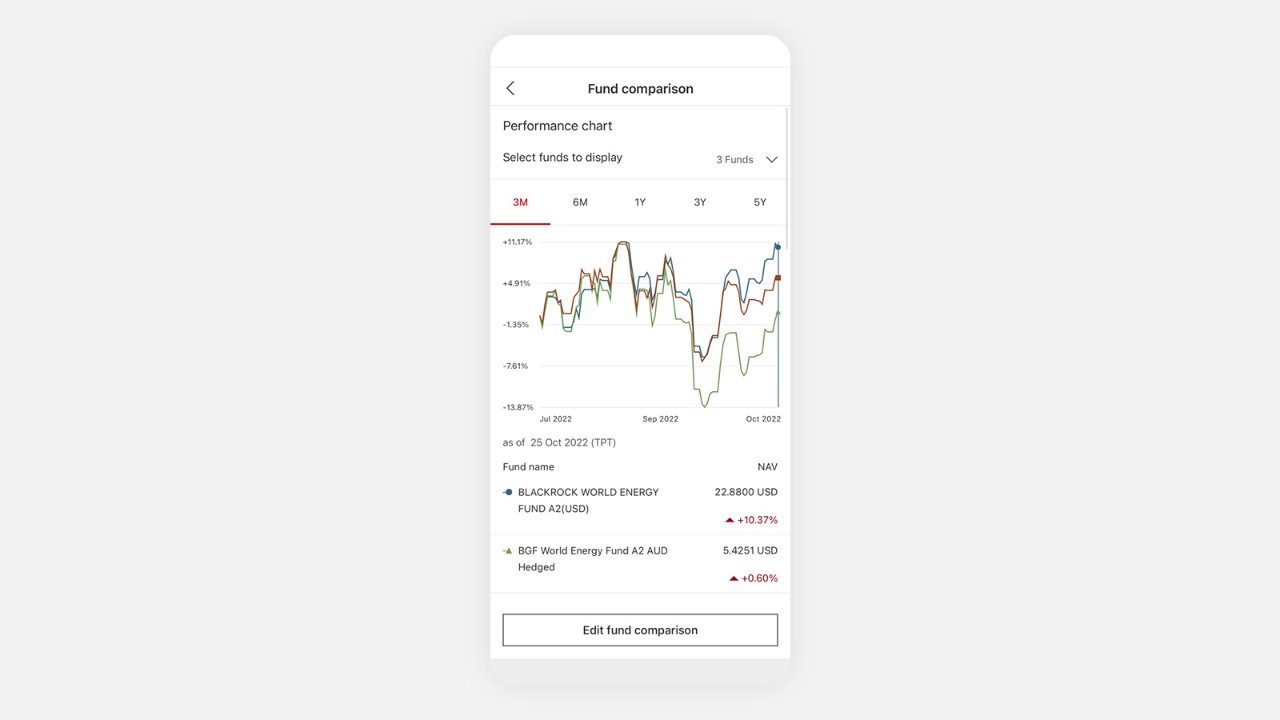

- Compare maximum 3 funds at the same time via HSBC TW APP

- 20 criteria to filter for funds comparison

Step 1. Click on ‘…’ next to the fund you want to compare.

Step 2. Click on ‘Add this fund to compare’.

Step 3. View fund comparison details.

【Download HSBC (Taiwan) App now】

i-Invest: Complete an investment transaction in just three steps!

Search and Select Unit Trusts

Click "buy" and put in required data

Click "confirm"

- Set up your monthly investment plan every day and in 10 different currencies.

- The variety Unit Trusts overview will provide all the fund information you need.

- Customized investment market news can help you find the one that meets your financial needs.

How to use i-Invest for Unit Trusts (Chinese Version Only)

Use i-Invest to place an order directly

- Doesn’t have mobile APP yet?If you already have mobile APP, just log on to browse, buy and sell funds.

- Existing customer ?If you already invest with HSBC, just log on to browse, buy and sell funds.

- Not yet a customer?If you have not applied for online banking, you can also register online and get the fund subscription discount.

Other ways to place the order

- New customer?Welcome to apply for the HSBC Premier Banking Account and enjoy the banking and wealth management services provided by Premier Banking.

You might also be interested in

Investment risk tolerance

Understand your investment risk tolerance to build investment strategies!

Unit Trusts

Diversify your portfolio with HSBC, you can choose from a wide range of funds to match your attitude to risk and investment goals.

Monthly Investment Plan (MIP) Fund

Provide greater flexibility and better access to market updates while letting you use funds flexibly to achieve goals sustainably.