Key takeaways

- We look for a steady USD, with discussions around the Fed remaining a key focus

- The JPY is likely to strengthen in the weeks ahead, potentially helped by a hawkish BoJ

- A stagflation narrative may weigh on the GBP, and we see mostly sideways moves in others

Our tactical view

Table of tactical views where a currency pair is referenced (e.g. USD/JPY):An up (⬆) / down (⬇) / sideways (➡) arrow indicates that the first currency quotedin the pair is expected by HSBC Global Research to appreciate/depreciate/track sideways against the second currency quoted over the coming weeks. For example, an up arrow against EUR/USD means that the EUR is expected to appreciate against the USD over the coming weeks. The arrows under the “current” represent our current views, while those under “previous” represent our views in the last month’s report.

USD

We look for the USD to track sideways over the coming weeks, but a lot of moving parts are in play including trade policy, geopolitics and issues around the Federal Reserve (Fed) that will push and pull the USD. Recent trade deals have reduced but not removed policy uncertainties, with details being worked through. Higher US tariffs would likely support the USD. That said, the USD still has an uncertain “safe haven” allure when it comes to geopolitics and risk aversion. The US Senate will return from recess in early September and the nomination process for Stephen Miran (who authored the ‘Mar-a-Lago Accord’ which laid out a framework to weaken the USD) to join the Federal Open Market Committee (FOMC) will likely move quickly ahead, perhaps in time for the 16-17 September FOMC meeting. Markets price in a c73% likelihood of a 25bp cut (Bloomberg, 21 August 2025) and will likely react more to any hawkish surprise than to a dovish one when coming to US non-farm payroll report (5 September) and CPI data (11 September).

Short-term direction : DXY^

Current

▶ Track Sideways

Previous

▶ Track Sideways

EUR

EUR-USD is likely to move largely sideways over the coming weeks, with some modest upside from the prospects of a ceasefire or peace between Russia and Ukraine which have been elusive to date. The European Central Bank’s (ECB) inaction is almost fully priced in at its 11 September meeting. Given the Fed is likely to cut rates in September, the balance of risks might point to some modest EUR-USD upside, even if this divergence is well anticipated. That said, French political risk ahead of the next round of budget negotiations in September could weigh on the EUR, as might any talk of secondary tariffs.

Short-term direction : EUR-USD

Current

▶ Track Sideways

Previous

▶ Track Sideways

Short-term direction : EUR-GBP

Current

▲ Appreciate

Previous

▶ Track Sideways

GBP

Interest rate differentials may return to drive the GBP, as trade tensions recede and stagflation fears mount. In the UK, persistent inflation (with the CPI data for August to be released on 17 September) will probably suggest that another 25bp cut by the Bank of England (BoE) this year seems finely balanced, despite weak economic fundamentals. Markets expect the BoE to keep rates steady at its 18 September meeting (Bloomberg, 21 August 2025). With uncertainty clouding both monetary and fiscal policies, on top of mounting stagflation fears, downside risks to the GBP look set to build over the coming weeks.

Short-term direction : GBP-USD

Current

▼ Depreciate

Previous

▶ Track Sideways

JPY

There is scope for the JPY to strengthen somewhat over the coming weeks. Rate differentials are becoming more important in the FX market, which could point to some USD-JPY downside, especially if the Bank of Japan (BoJ) is more hawkish in the 18-19 September meeting when the Fed will likely resume its easing in September. Converging US-Japan rates would also reduce hedging costs and perhaps encourage domestic investors to increase their hedge ratios, supporting the JPY. The FX market is no longer so worried about political uncertainty in Japan and what the knock-on impact may be for fiscal policy.

Short-term direction : USD-JPY

Current

▼ Depreciate

Previous

▲ Appreciate

Short-term direction : EUR-JPY

Current

▼ Depreciate

Previous

▲ Appreciate

CHF

Tariff concerns have weighed on the CHF over the recent weeks. In particular, tariffs on pharmaceuticals (which represent c11% of total Swiss exports) could weigh on Switzerland’s current account. The Swiss National Bank (SNB) has appeared cautious about implementing negative rates, and market probability for a 25bp cut could rise from below c20% currently for the 25 September meeting, providing another headwind for the CHF. All in all, EUR-CHF and USD-CHF are likely to be higher in the weeks ahead.

Short-term direction : USD-CHF

Current

▲ Appreciate

Previous

▼ Depreciate

Short-term direction : EUR-CHF

Current

▲ Appreciate

Previous

▼ Depreciate

CAD

The main driver for USD-CAD remains movements in the broad US Dollar Index (that excludes the CAD), which we look for consolidation. However, the risks are skewed to the upside from Canada-specific factors. Rates market is fully priced for one more Bank of Canada (BoC) cut by year-end but attaches a one-third likelihood to a cut at its 17 September meeting, and a 60% likelihood to a move in October (Bloomberg, 21 August 2025). The more critical determinants are likely to be the June (and Q2) GDP data on 29 August, followed by the August employment report on 5 September.

Short-term direction : USD-CAD

Current

▶ Track Sideways

Previous

▶ Track Sideways

AUD

External factors have turned less favourable, like lacklustre emerging Asian currency performance and waning influence of risk sentiment on the AUD, pausing the AUD-USD rise. We stay cautious on AUD-USD over the near term, but we think monetary and fiscal easing globally should provide a cushion for downside growth risks which could support the AUD over the medium term. Australia’s resilient macro story could be reflected in a higher AUD-NZD in the weeks ahead.

Short-term direction : AUD-USD

Current

▶ Track Sideways

Previous

▲ Appreciate

Short-term direction : AUD-NZD

Current

▲ Appreciate

Previous

▶ Track Sideways

NZD

We turn cautious over the near-term outlook for NZD-USD. The Reserve Bank of New Zealand (RBNZ) lowered its policy rate by 25bp to 3% on 20 August, with a 50bp discussed and a downward revision to its official policy rate projection for 1Q26 to 2.55% (previously 2.85%). This has weighed on the NZD. Ultimately, the broad USD direction and emerging Asian currency performance should return as the dominant drivers for NZD-USD. But for now, a consolidation in NZD-USD seems likely in the weeks ahead.

Short-term direction : NZD-USD

Current

▶ Track Sideways

Previous

▲ Appreciate

Note: ^DXY = US Dollar Index, is an index (or measure) of the value of the USD against major global currencies, including the EUR, JPY, GBP, CAD, SEK and CHF. N/A = Not applicable, as we only provide short-term direction for those currency pairs from this issue. Source: HSBC

FX Data Snapshot

(from close on 23 July to 22 August*)

Heading and description can't be both empty

| FX |

Spot |

200 dma |

1-month % change* |

Support |

Resistance |

|---|---|---|---|---|---|

| DXY |

98.72 | 102.81 | 1.36% | 97.50 | 99.50 |

| EUR-USD |

1.1602 | 1.1005 | -1.29% | 1.1380 | 1.1750 |

| EUR-GBP | 0.8647 | 0.8449 | 0.44% | 0.8575 | 0.8740 |

| GBP-USD | 1.3418 | 1.3022 | -0.85% | 1.3140 | 1.3600 |

| USD-JPY |

148.65 | 149.13 | -1.36% | 145.70 | 150.00 |

| EUR-JPY | 172.47 | 163.93 | -0.06% | 170.00 | 174.00 |

| USD-CHF |

0.8092 | 0.855 | -2.09% | 0.8000 | 0.8200 |

| EUR-CHF | 0.9389 | 0.9388 | -0.81% | 0.9300 | 0.9460 |

| USD-CAD | 1.3912 | 1.4037 | -2.21% | 1.3720 | 1.4037 |

| AUD-USD |

0.6424 | 0.6383 | -2.01% | 0.6384 | 0.6570 |

| AUD-NZD | 1.1060 | 1.0946 | -1.25% | 1.1000 | 1.1120 |

| NZD-USD |

0.581 | 0.5833 | -3.23% | 0.5650 | 0.5950 |

| FX |

DXY |

|---|---|

| Spot |

98.72 |

| 200 dma |

102.81 |

1-month % change* |

1.36% |

| Support |

97.50 |

| Resistance | 99.50 |

| FX |

EUR-USD |

| Spot |

1.1602 |

| 200 dma |

1.1005 |

1-month % change* |

-1.29% |

| Support |

1.1380 |

| Resistance | 1.1750 |

| FX |

EUR-GBP |

| Spot |

0.8647 |

| 200 dma |

0.8449 |

1-month % change* |

0.44% |

| Support |

0.8575 |

| Resistance | 0.8740 |

| FX |

GBP-USD |

| Spot |

1.3418 |

| 200 dma |

1.3022 |

1-month % change* |

-0.85% |

| Support |

1.3140 |

| Resistance | 1.3600 |

| FX |

USD-JPY |

| Spot |

148.65 |

| 200 dma |

149.13 |

1-month % change* |

-1.36% |

| Support |

145.70 |

| Resistance | 150.00 |

| FX |

EUR-JPY |

| Spot |

172.47 |

| 200 dma |

163.93 |

1-month % change* |

-0.06% |

| Support |

170.00 |

| Resistance | 174.00 |

| FX |

USD-CHF |

| Spot |

0.8092 |

| 200 dma |

0.855 |

1-month % change* |

-2.09% |

| Support |

0.8000 |

| Resistance | 0.8200 |

| FX |

EUR-CHF |

| Spot |

0.9389 |

| 200 dma |

0.9388 |

1-month % change* |

-0.81% |

| Support |

0.9300 |

| Resistance | 0.9460 |

| FX |

USD-CAD |

| Spot |

1.3912 |

| 200 dma |

1.4037 |

1-month % change* |

-2.21% |

| Support |

1.3720 |

| Resistance | 1.4037 |

| FX |

AUD-USD |

| Spot |

0.6424 |

| 200 dma |

0.6383 |

1-month % change* |

-2.01% |

| Support |

0.6384 |

| Resistance | 0.6570 |

| FX |

AUD-NZD |

| Spot |

1.1060 |

| 200 dma |

1.0946 |

1-month % change* |

-1.25% |

| Support |

1.1000 |

| Resistance | 1.1120 |

| FX |

NZD-USD |

| Spot |

0.581 |

| 200 dma |

0.5833 |

1-month % change* |

-3.23% |

| Support |

0.5650 |

| Resistance | 0.5950 |

Note: * as at 17:42 HKT on 22 August 2025

Source: HSBC, Bloomberg

Explanation of terms

Spot: Spot refers to the current market price of a currency pair that is important for immediate transactions.

200 dma: 200-day simple moving average numberrepresents the average price of an index or a currency pair over the past 200 days.

Support (S), Resistance (R):Support and resistance are significant previous lows and highs plus retracement levels, based on historical price patterns of anindex or a currency pair. Support is a historical price level where a downtrend of a currency pair paused due to demand for the first currency quoted in the pair increasing, while resistance is a historical price level where an uptrend of a currency pair reversed amid demand for the second currency quoted in the pair increasing.

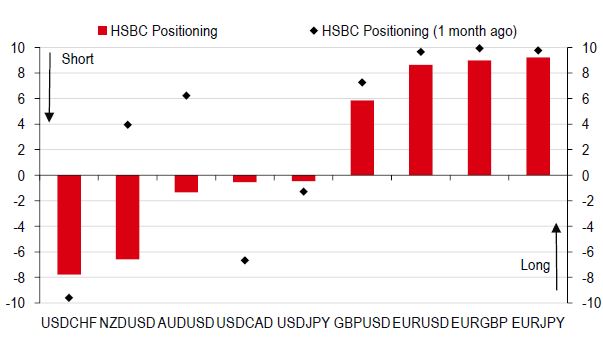

HSBC Positioning Indices

The indicators have been devised to track the net position of momentum traders, looking at hundreds of strategies, operating over many different time horizons. It considers time horizons of 5 days up to 260 days. An indicator level of +10 would indicate that the hundreds of different strategies have all lined up and gone long (i.e., buy the first currency quoted in the pair). Similarly, an indicator level of -10 indicates that all strategies are short (i.e., sell the first currency quoted in the pair).

Glossary

Dovish

Dovish refers to an economic outlook which generally supports low interest rates as a means of encouraging growth within the economy.

Hawkish

Hawkish is typically used to describe monetary policy which favours higher interest rates, and tighter monetary controls to keep inflation in check.

MoM / YoY

Month on month / Year on year

PMI

Purchasing Managers Index (PMI) is an indicator of economic health of the manufacturing sector (>50 represents expansion vs. the previous month).

IMM data

International Monetary Market (IMM) is a division of the Chicago Mercantile Exchange (CME) that deals with the trading of currencies and interest rate futures and options and the IMM data is part of the Commitments of Traders (COT) reports published by the U.S. Commodity Futures Trading Commission (CFTC). The IMM data provides a breakdown of each Tuesday’s open futures positions on the IMM. Speculative positions are a trader’s non-commercial positions (i.e. not for hedging purposes).

G10

G10 refers to the most heavily traded, liquid currencies in the world: USD, EUR, JPY, GBP, CHF, AUD, NZD, CAD, NOK, and SEK.

Fed / FOMC

Federal Reserve System (US’s Central Bank)/Federal Open Market Committee.

ECB

European Central Bank (Eurozone’sCentral Bank).

BOE

Bank of England (UK’s Central Bank).

BOJ

Bank of Japan (Japan’s Central Bank).

BOC

Bank of Canada (Canada’s Central Bank).

RBA

Reserve Bank of Australia (Australia’s Central Bank).

RBNZ

Reserve Bank of New Zealand (New Zealand’s Central Bank).

SNB

Swiss National Bank (Switzerland’s Central Bank).

Related insights

FX Viewpoint: USD: Focus on the Fed

USD weakness has paused lately, but could resume...[18 Aug]

FX Viewpoint: GBP: The BoE’s hawkish cut

As expected, the BoE delivered a 25bp cut in August...[11 Aug]

FX Viewpoint: JPY: A still dovish BoJ

The BoJ kept rates steady in July, as expected. [4 Aug]

Important information

Important disclosures

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments (including derivatives) of companies covered in HSBC Research on a principal or agency basis.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

Additional disclosures

- This report is dated as at 22 August 2025.

- All market data included in this report are dated as at close 21 August 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business.Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

Disclaimer

This document or video is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document or video is distributed and/or made available, HSBC Bank (China) Company Limited, HSBC Bank (Singapore) Limited, HSBC Bank Middle East Limited (UAE), HSBC UK Bank Plc, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (20080100642 1 (807705-X)), HSBC Bank (Taiwan) Limited, HSBC Bank plc, Jersey Branch, HSBC Bank plc, Guernsey Branch, HSBC Bank plc in the Isle of Man, HSBC Continental Europe, Greece, The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank (Vietnam) Limited, PT Bank HSBC Indonesia (HBID), HSBC Bank (Uruguay) S.A. (HSBC Uruguay is authorised and oversought by Banco Central del Uruguay), HBAP Sri Lanka Branch, The Hongkong and Shanghai Banking Corporation Limited – Philippine Branch, HSBC Investment and Insurance Brokerage, Philippines Inc, and HSBC FinTech Services (Shanghai) Company Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document or video is for general circulation and information purposes only.

The contents of this document or video may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document or video must not be distributed in any jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document or video will be the responsibility of the user and may lead to legal proceedings. The material contained in this document or video is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document or video may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HBAP and the Distributors do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document or video has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed are based on the HSBC Global Investment Committee at the time of preparation and are subject to change at any time. These views may not necessarily indicate HSBC Asset Management‘s current portfolios’ composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients’ objectives, risk preferences, time horizon, and market liquidity.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document or video is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investments are subject to market risks, read all investment related documents carefully.

This document or video provides a high-level overview of the recent economic environment and has been prepared for information purposes only. The views presented are those of HBAP and are based on HBAP’s global views and may not necessarily align with the Distributors’ local views. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. It is not intended to provide and should not be relied on for accounting, legal or tax advice. Before you make any investment decision, you may wish to consult an independent financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you. You are advised to obtain appropriate professional advice where necessary.

The accuracy and/or completeness of any third-party information obtained from sources which we believe to be reliable might have not been independently verified, hence Customer must seek from several sources prior to making investment decision.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”): HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India does not distribute or refer investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or any other jurisdiction where such distribution or referral would be contrary to law or regulation.

HSBC India is an AMFI-registered Mutual Fund Distributor of select mutual funds and a referrer of other 3rd party investment products. HSBC India will receive commission from HSBC Asset Management (India) Private Limited, in its capacity as a AMFI registered mutual fund distributor of HSBC Mutual Fund. The Sponsor of HSBC Mutual Fund is HSBC Securities and Capital Markets (India) Private Limited (HSCI), a member of the HSBC Group. Please note that HSBC India and the Sponsor being part of the HSBC Group, may give rise to real, perceived, or potential conflicts of interest. HSBC India has a policy in place to identify, prevent and manage such conflict of interest. For more information related to investments in the securities market, please visit the SEBI Investor Website: https://investor.sebi.gov.in/ and the SEBI Saa₹thi Mobile App. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Issued by The Hongkong and Shanghai Banking Corporation Limited India. Incorporated in Hong Kong SAR with limited liability. HSBC Bank ARN - 0022 with validity from 19-Feb-2024 to 18-Feb-2027. Date of initial registration: 19-Feb-2002.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

The following statement is only applicable to PT Bank HSBC Indonesia (“HBID”): HBID is licensed and supervised by Indonesia Financial Services Authority (“OJK”). Investment products that are offered in HBID are third party products, HBID is a selling agent for third party products such as Mutual Funds and Bonds. HBID and HSBC Group (HSBC Holdings Plc and its subsidiaries and associates company or any of its branches) do not guarantee the underlying investment, principal or return on customer’s investment. You must read and understand the investment policy of each investment product to see if a product contains ESG and sustainability elements and is classified as an ESG and sustainable investment. Investment in Mutual Funds and Bonds are not covered by the deposit insurance program of the Indonesian Deposit Insurance Corporation (“LPS”).

Important information on ESG and sustainable investing

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

THE CONTENTS OF THIS DOCUMENT OR VIDEO HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG OR ANY OTHER JURISDICTION.

YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT OR VIDEO. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT OR VIDEO, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.