Affluent Investor Snapshot 2025: A Quality of Life special report1

We surveyed over 10,000 affluent individuals across 12 markets and asked some simple yet important questions about investment behaviours worldwide.

Smart money moves: Security through diversification

By Willem Sels

Global Chief Investment Officer, HSBC Private Bank and Premier Wealth

Key takeaways

- Start early, diversify smart – Affluent investors are prioritising early investment and strategic diversification over speculation.

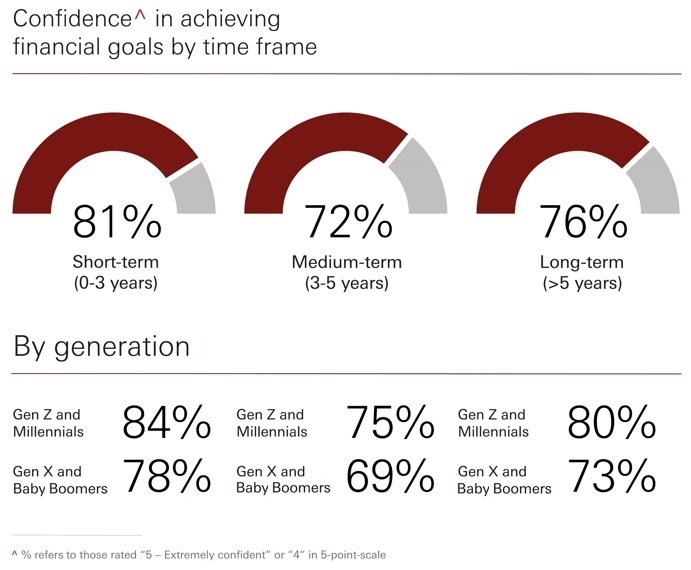

- Youth leads the charge – Younger generations with wealth are showing unprecedented confidence in building diversified portfolios across traditional and alternative assets.

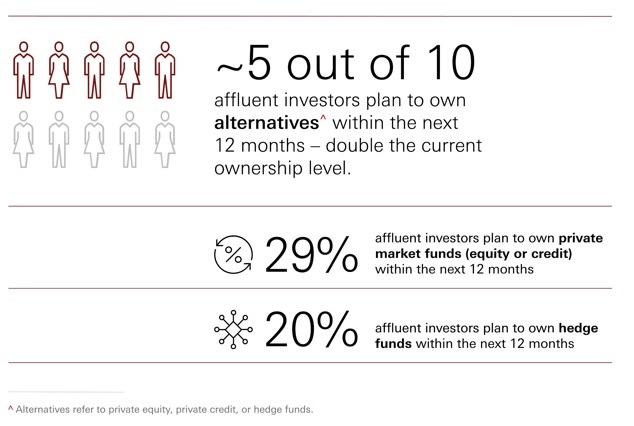

- Beyond stocks and bonds – Gold, hedge funds and private markets are becoming mainstream portfolio components, not just exotic alternatives.

This year's Affluent Investor Snapshot continues to explore how affluent investors are navigating their investment and wealth decisions, and how these choices are reflected in the way they build their portfolios to meet short, medium and long-term objectives.

Why your portfolio should be more than just stocks

Every portfolio tells a story—not just of wealth, but of what really matters: family, freedom, future plans, and the trade-offs we make along the way. And that story is constantly evolving. This year’s Affluent Investor Snapshot reveals how investors are adapting—getting more strategic, more confident, and yes, more diversified.

Two rules apply to all objectives. First, start early on your investment journey to help you accumulate wealth rapidly and make a difference later in life. The survey data below show that the younger generations are actually doing that now and show more confidence in their wealth and investment decisions.

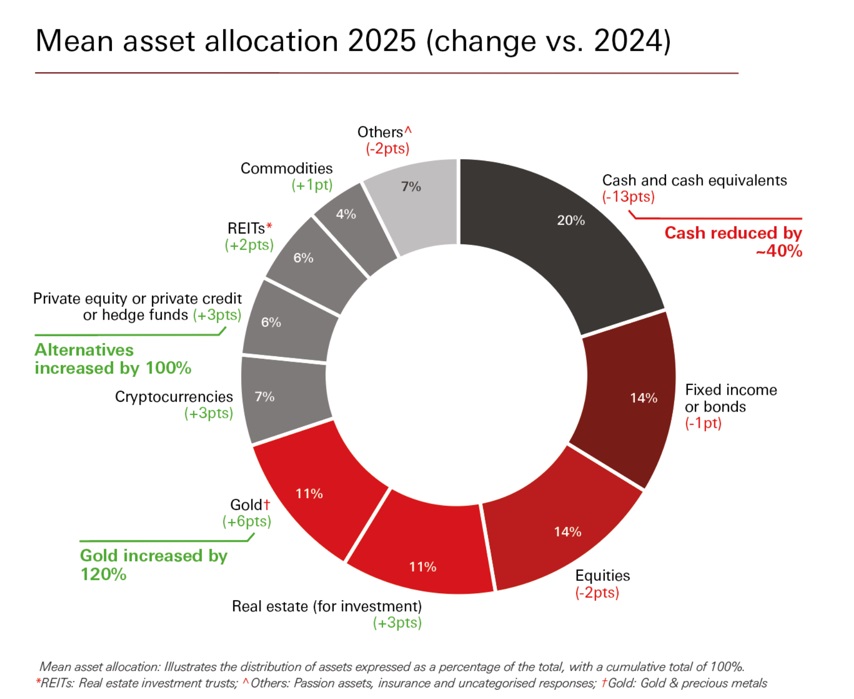

Second, diversifying portfolios by combining different investments across bonds, stocks and alternative assets can smoothen the investment journey. Holding cash and waiting to invest can be a drag on performance. Survey data show affluent investors' primary concern is high inflation, which raises costs and erodes cash's purchasing power. Encouragingly, these investors have reduced cash positions and deployed capital more strategically.

Respondents also seem to be following this second point. Allocations to equities and bonds have remained relatively constant, but they have added significantly to alternative assets such as gold, real estate, hedge funds and private markets, a trend that looks set to persist. The rise in cryptocurrencies is also notable, but as this asset class is still relatively new and unproven, we can’t say for sure whether it’s a good diversifier.

How diversification works: a practical example

Conventional wisdom says that equities outperform most other asset classes in the long run. Many investors start out with stocks because it can be fun to select stocks that are in the news and invest in companies that are at the next frontier of innovation.

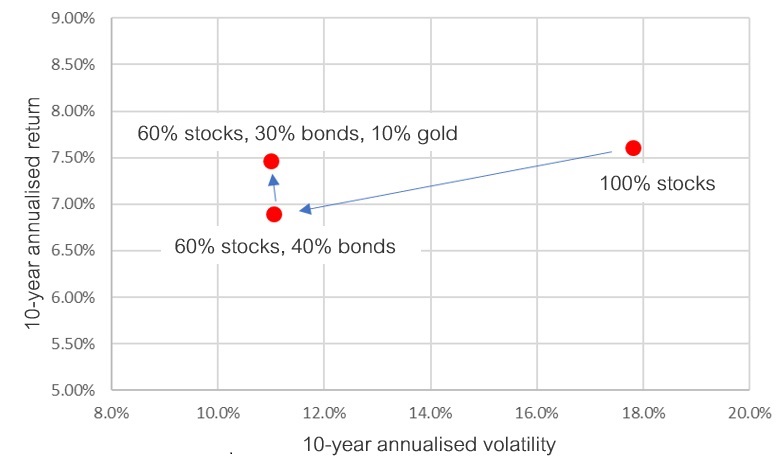

But what if you could build a portfolio that offers equity-like returns, but with lower risk? Diversification can help achieve this objective, as shown in the chart below.

Starting with a portfolio that is entirely composed of US equities, adding 40% of bonds would have materially reduced the volatility over the last 10 years, while having only a relatively small impact on returns. By taking the extra step of adding 10% of gold, the portfolio returns would have increased while keeping the portfolio risk almost constant. Further steps could be taken to then add other assets, such as emerging market equities or hedge funds, and this would have additionally improved the risk-return profile of the portfolio.

Even using just three asset classes, diversification clearly beats concentration. A mixed portfolio delivers nearly identical returns to holding 100% stocks, but with 40% less volatility.

Why this happens

Two investments, even with similar risk levels, rarely move in perfect sync. When one surges, another may decline or hold steady, meaning your portfolio experiences smaller swings than its most volatile component. That's diversification shielding you from excessive volatility.

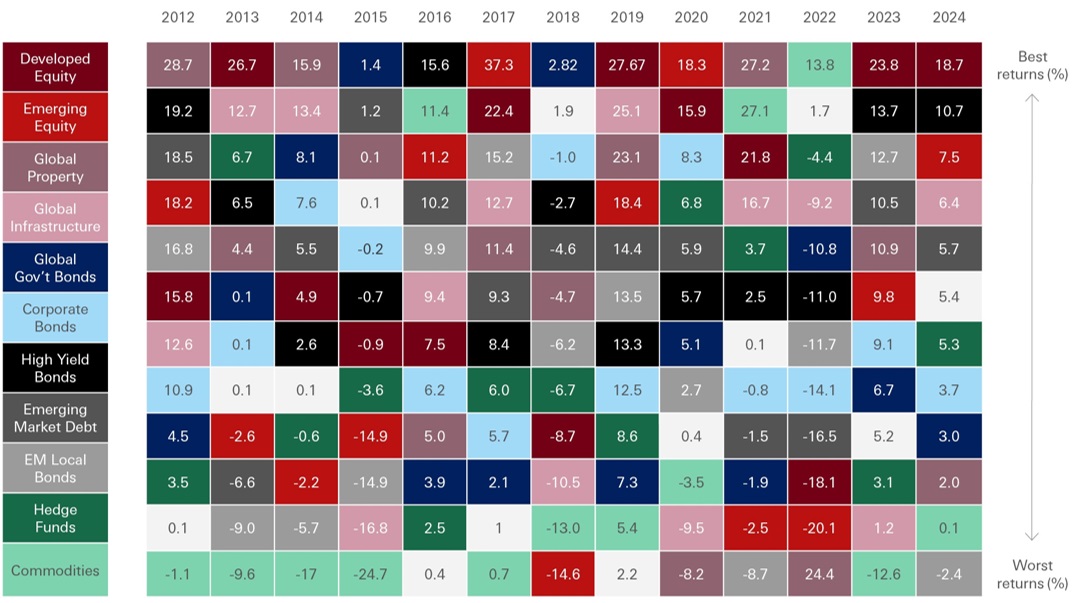

Take a look at what has happened in recent years to illustrate this point. The table below shows the returns for different types of investments and ranks them for each year. Equities, which are typically considered relatively high risk, have some very good years but also bad ones. High quality bonds rarely have very negative years, but they can underperform other assets when equities and risky asset rally sharply. Therefore, no investment consistently outperforms, and it is hard to predict which will do best in any given year. This is another very good reason to diversify a portfolio because it helps improve a portfolio’s risk-return profile and taps into a broader range of investment opportunities.

No single asset class consistently outperforms

How to achieve good diversification?

The first step is to ensure that your individual stock holdings aren’t too concentrated. Companies’ earnings can be volatile, and you can sharply reduce the impact of company-specific headlines by owning more than one stock in the same sector. Of course, diversifying across sectors further reduces the risk, as it exposes you to the broader economy rather than one specific sector.

Next comes geographical diversification, which reduces the risk while expanding investment opportunities across global markets. Finally, diversification extends beyond stocks to include bonds, gold, hedge funds and other asset classes.

The path forward is clear

The evidence is compelling: diversification isn't just prudent—it's a smart move. The most successful investors understand this isn't about playing it safe; it's about playing it smart. In volatile markets, spreading risk across asset classes, sectors, and geographies has become essential for serious wealth building.

Your portfolio should reflect not just where your money is today, but where your financial future is headed. The affluent investors in our snapshot have already started building in those features. The question is whether you'll follow their lead.

Getting Started with Investments

Create an investment strategy in simple steps

Wealth Insights

Read our latest insights curated to meet your investment and wealth needs

Notes

1. The Affluent Investor Snapshot 2025, a global Quality of Life special report by HSBC, delves into the investment portfolios, behaviours, and priorities of affluent individuals worldwide. Conducted in March 2025 through an online survey across 12 markets, this research captures insights from 10,797 affluent investors aged 21 to 69, each possessing investable assets ranging from USD 100,000 to USD 2 million.