Affluent Investor Snapshot 2025: A Quality of Life special report1

We surveyed over 10,000 affluent individuals across 12 markets and asked some simple yet important questions about investment behaviours worldwide.

Wealth across generations: Strategies for a secure future

By William Chan

Chief Investment Officer and Head of Investments, Insurance, HSBC

Key takeaways

- A growing number of affluent investors regard insurance as a key wealth management tool given its potential to help protect, grow and transfer wealth. This realignment is being observed across all generations and in various geographies.

- 8 out of 10 affluent investors are proactively reducing their cash holdings and adjusting their investment approach whilst 8 out of 10 Gen Z and Millennials have a positive outlook toward their future objectives.

- 8 out of 10 affluent investors seek advice from experts when making investment and wealth management decisions, preferring tailored and innovative recommendations, such as insurance-focused strategies.

Affluent investors are turning to insurance in the pursuit of a wealth management tool that can safeguard, enhance and help transfer their wealth. Moreover, with confidence high that their goals will be reached, the majority of these investors are working closely with financial experts to forge customised and innovative insurance-focused portfolio strategies.

Boosting financial resilience with insurance

Against a backdrop of sticky inflation, global uncertainty, and market volatility, the Affluent Investor Snapshot 2025 highlights a growing sense of resilience, with 8 out of 10 respondents proactively reducing their cash holdings and adjusting their investment approach in the pursuit of more diversified portfolios with a wider range of instruments.

In tandem, the research shows that holding insurance products, not only provides peace of mind but also boosts investors' confidence in meeting their financial targets over different timeframes. Insurance products, like life insurance or guaranteed savings products, typically offer a longer investment horizon, making them an attractive option for individuals seeking stability and security in their financial planning.

Specifically, a growing number of investors see insurance as a key wealth management tool that can help protect, grow and transfer wealth. This realignment is being observed across all generations and in various geographies, with, for example, 41% of affluent investors in mainland China and 47% in Indonesia planning to own insurance products within the next 12 months. People are focused, too, on creating insurance-driven income streams to protect against inflation. For them, financial security is just as important as seeking growth opportunities.

Insurance is an important part of a diversified portfolio. It boosts confidence in addressing both short-term and long-term financial needs by providing opportunities to grow, protect and transfer wealth.

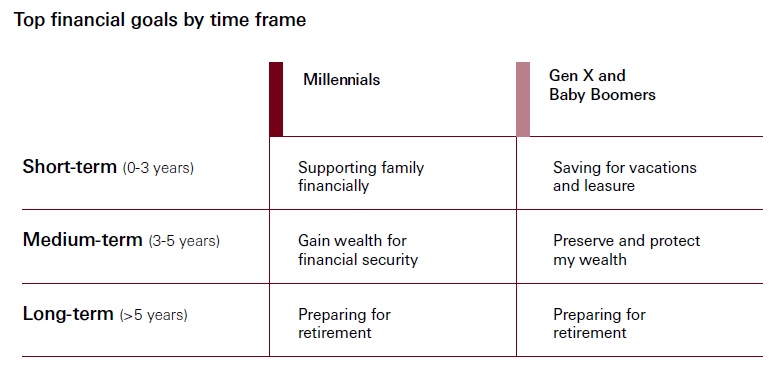

Supporting financial goals across generations

The Affluent Investor Snapshot 2025 highlights a rising confidence among respondents that they will achieve their financial goals, such as homeownership, education savings for children or grandchildren, health coverage and supporting meaningful causes. Promisingly, 8 out of 10 Gen Z and Millennials have a positive outlook regarding their future objectives.

A noteworthy development is that savings and personal wellbeing are now a high priority for all generations. Financial success not only helps investors reach tomorrow’s goals, but it also allows people to enjoy their lives today.

Retirement, legacy planning and diversification redefined

Drilling deeper and insurance products certainly play a key role in retirement planning, given the ability to build wealth steadily over time. Dividends from guaranteed savings products, such as annuities, can also serve as a reliable source of income in later years.

However, insurance supports more than just retirement. We’re seeing a growing trend among our customers, as they look for lower-risk ways, like life insurance, to transfer their wealth seamlessly to the next generation, particularly in times of market volatility. This critical shift demonstrates that affluent investors increasingly recognise the benefits of blending insurance into their investment strategies to meet individual and family life goals.

Meanwhile, some legacy planning products can facilitate a seamless transition of wealth. For instance, insurance can provide more flexibility, liquidity and divisibility, especially since family wealth is often complex, and money can be tied up in property or business. Insurance can also help to avoid difficult conversations, because of its privacy and incontestability aspects.

Insurance isn’t just a tool for protection or retirement; it’s a key part of a diversified wealth portfolio.

Expert guidance for a future-ready financial strategy

Highly resilient investors tend to have more diversified portfolios, with insurance products playing a pivotal role. The recipe for resilience requires various ingredients, with two of the most important being comprehensive planning and proper financial knowledge.

Notably, the Affluent Investor Snapshot 2025 indicates that people are seeking investment information from multiple sources, with social media and online banking emerging as the primary channels. However, 8 out of 10 affluent investors seek guidance from experts when making investment and wealth management decisions, preferring tailored and innovative recommendations, such as insurance-focused strategies2.

Similarly, the HSBC Research Fellowship3, in collaboration with the University of Oxford’s Wellbeing Research Centre, has pinpointed the vital role that financial planning plays in achieving a well-balanced life. Those who plan holistically across multiple spheres, such as healthcare protection, wealth accumulation, retirement and legacy planning, are shown to be 50% more satisfied with their quality of life.

HSBC Life Wealth and Financial Planning Specialists are more than just advisors – they’re financial strategists who help customers plan comprehensively for their future, empowering them to achieve their goals with confidence. A commitment to guiding customers through their financial aspirations is at the heart of everything we do.

Securing a legacy with tailored insurance solutions

With its distinct combination of protection, growth potential and wealth transfer attributes, insurance is becoming a central element of affluent investors’ wealth management strategies.

In parallel, there is rising confidence that people will achieve their financial goals, particularly among younger generations, coupled with a growing focus on diversification, which means that insurance products are being steadily integrated into investment portfolios.

Expert guidance and tailored solutions play a crucial role, too, helping affluent investors build resilient strategies, secure their financial future, and leave a meaningful legacy.

So start planning today. Speak to one of HSBC Life's Wealth and Financial Planning Specialists to learn more about the incredible potential that insurance holds.

Protect and grow your wealth

Looking to build your wealth? Planning your retirement? Or saving for your child's education? Let us help you achieve that while giving you life protection too

Take the next step

Discover how we can support your journey towards success

Notes

1. The Affluent Investor Snapshot 2025, a global Quality of Life special report by HSBC, delves into the investment portfolios, behaviours, and priorities of affluent individuals worldwide. Conducted in March 2025 through an online survey across 12 markets, this research captures insights from 10,797 affluent investors aged 21 to 69, each possessing investable assets ranging from USD 100K to USD 2M.

2. Experts include wealth and financial specialists, bank relationship managers (RMs), stockbrokers and insurance agents.

3. HSBC and the Wellbeing Research Centre at the University of Oxford have partnered to advance the understanding of the relationship between financial health and general wellbeing. The fellowship will conduct interdisciplinary research on the role and impact that different themes, such as financial fitness and mental wellbeing, play in our overall quality of life.